Find Out Your Perfect Personal Property Coverage Now

If you're seeking peace of mind with the right personal property coverage, now is the time to explore your options, browse choices, and secure the protection that best fits your needs.

Understanding Personal Property Coverage

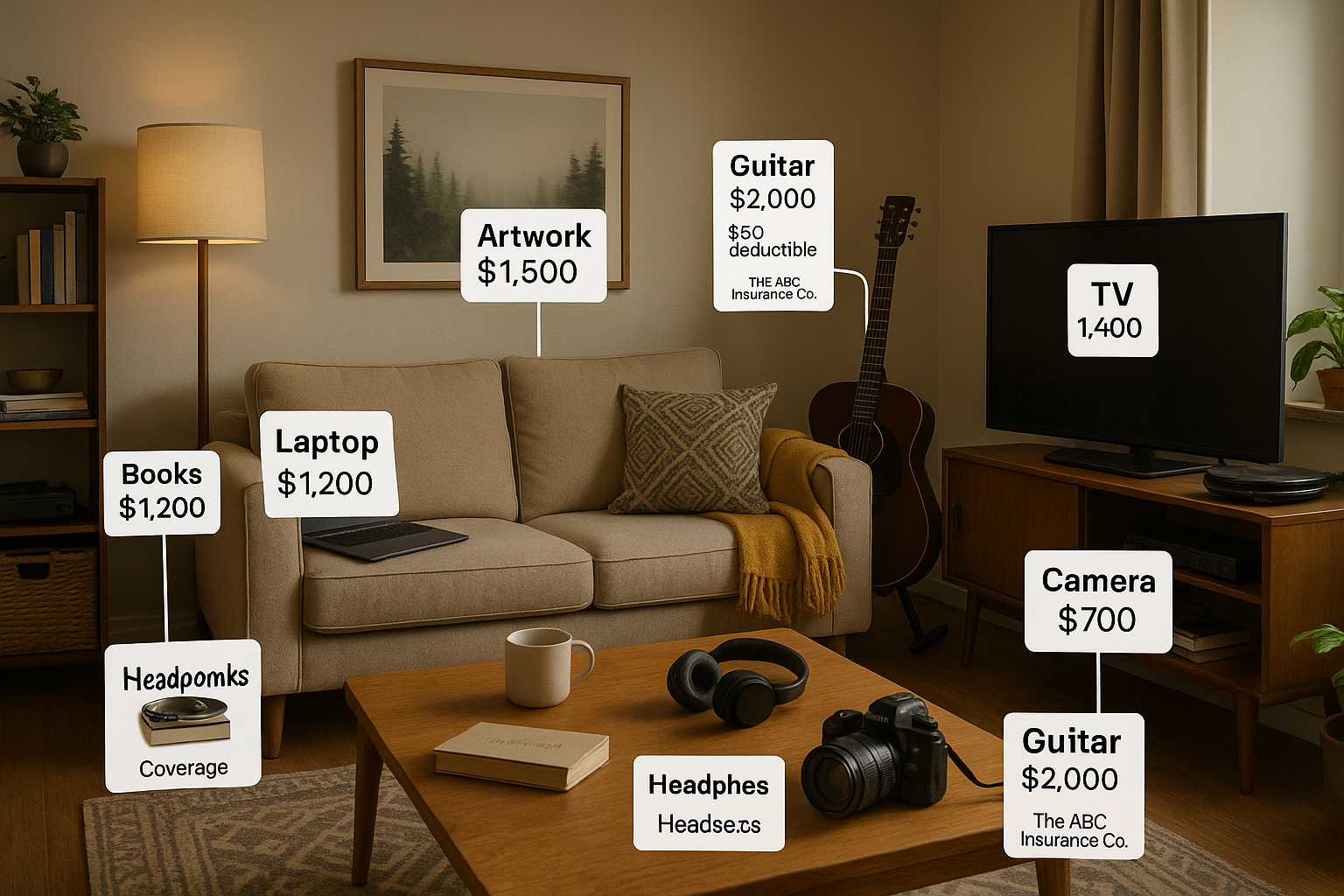

Personal property coverage is an essential component of homeowners or renters insurance that protects your belongings from unforeseen events like theft, fire, or natural disasters. This type of coverage ensures that you can replace or repair your items without bearing the full financial burden. Whether you're a homeowner or a renter, having adequate personal property coverage can save you from significant out-of-pocket expenses.

Types of Personal Property Coverage

There are generally two types of personal property coverage: actual cash value and replacement cost value.

1. **Actual Cash Value (ACV):** This coverage reimburses you for the depreciated value of your items. For instance, if your five-year-old television is stolen, ACV will cover the cost of the TV minus depreciation.

2. **Replacement Cost Value (RCV):** RCV provides a higher level of protection by covering the cost to replace your items with new ones of similar kind and quality. While premiums for RCV are typically higher, the peace of mind and financial protection it offers can be well worth the investment.

Factors Influencing Coverage Costs

The cost of personal property coverage can vary based on several factors:

- **Location:** Living in areas prone to natural disasters or high crime rates may increase your premiums.

- **Coverage Limits:** Higher coverage limits offer more protection but also come with higher premiums.

- **Deductibles:** Choosing a higher deductible can lower your premium, but it means you'll pay more out-of-pocket in the event of a claim.

According to the Insurance Information Institute, the average cost of renters insurance, which includes personal property coverage, is around $179 per year1.

Maximizing Your Coverage

To ensure you have the right level of protection, consider conducting a home inventory. This involves documenting all your belongings, including their estimated values, which can help you determine the appropriate coverage amount. Additionally, some insurers offer discounts for bundling policies or installing security systems, which can help reduce your premiums.

Exploring Additional Resources

For those seeking specialized coverage options, such as high-value item insurance or flood coverage, it's beneficial to visit websites of insurance providers that offer tailored solutions. Many insurers provide online tools to help you calculate your coverage needs and compare policy options.

Personal property coverage is a crucial aspect of protecting your financial well-being. By understanding the types of coverage available, the factors influencing costs, and how to maximize your protection, you can make informed decisions that safeguard your belongings. Take the time to search options and explore the resources available to ensure you have the coverage that best suits your needs.