Get Home Insurance Everything You Need Instantly Explained

Get peace of mind by exploring how home insurance can protect your most valuable asset, and see these options to find the perfect coverage for your needs.

Understanding Home Insurance: The Basics

Home insurance is a crucial safeguard for homeowners, offering financial protection against a wide range of potential damages and losses. At its core, home insurance is designed to cover the cost of repairing or replacing your home and belongings in the event of disasters such as fires, theft, or natural calamities. This coverage not only ensures that you can recover from unexpected events but also provides liability protection if someone is injured on your property.

Types of Home Insurance Coverage

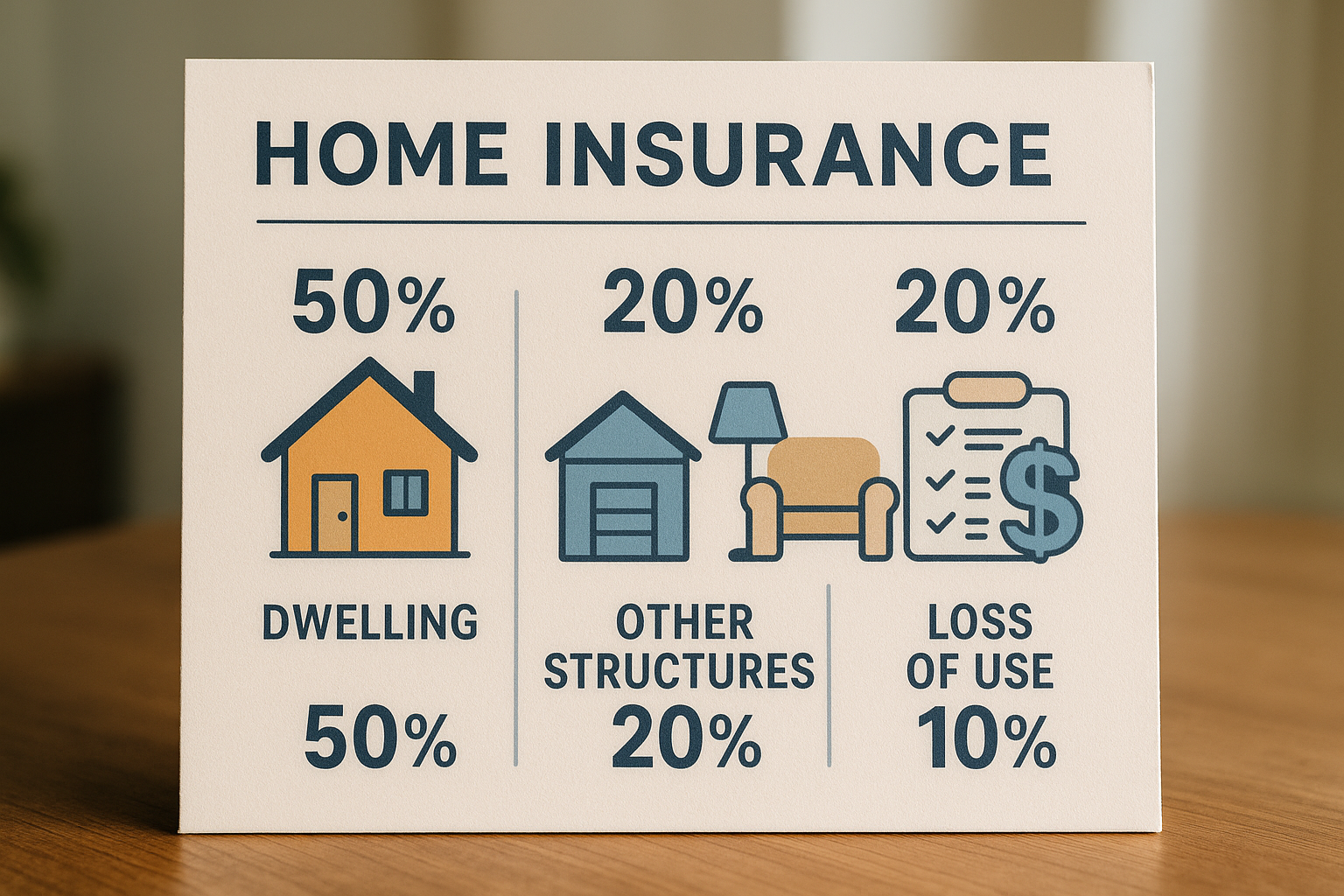

Home insurance policies typically include several types of coverage. The most common are:

1. **Dwelling Coverage**: This protects the physical structure of your home, including walls, roof, and built-in appliances, against covered perils.

2. **Personal Property Coverage**: This covers personal belongings such as furniture, electronics, and clothing, whether they are damaged at home or elsewhere.

3. **Liability Protection**: This provides coverage if you are legally responsible for someone else's injury or property damage.

4. **Additional Living Expenses (ALE)**: If your home becomes uninhabitable due to a covered loss, ALE covers the cost of living elsewhere temporarily.

5. **Medical Payments Coverage**: This pays for medical expenses if a guest is injured on your property, regardless of fault.

Factors Influencing Home Insurance Costs

Several factors influence the cost of home insurance, including the location of your home, its age and condition, and the coverage limits you select. Homes in areas prone to natural disasters may have higher premiums due to increased risk. Additionally, installing safety features such as smoke detectors and security systems can often lead to discounts on your policy1.

How to Choose the Right Policy

Choosing the right home insurance policy involves assessing your needs and comparing different options. Start by determining the value of your home and possessions to ensure adequate coverage. It’s also important to consider the reputation and financial stability of the insurance provider. Many insurers offer online tools to help you estimate your coverage needs and get quotes instantly2.

Common Discounts and Deals

Insurance companies often provide discounts to make coverage more affordable. Common discounts include bundling home and auto insurance, loyalty discounts for long-term customers, and reduced rates for homes with advanced security systems. Additionally, some insurers offer discounts for new homes or for policyholders who have not filed claims for several years3.

Exploring Specialized Options

For those with unique needs, such as high-value homes or properties in high-risk areas, specialized insurance options are available. These policies may offer higher limits or additional coverage for specific risks. It’s worth visiting websites of specialized insurers to explore these tailored options4.

In summary, home insurance is an essential investment to protect your home and belongings from unforeseen events. By understanding the different types of coverage, factors affecting costs, and available discounts, you can make an informed decision. As you search options and browse through various policies, remember that peace of mind is just a policy away.