Save Big Insure Your Home Below Replacement Cost

Unlock significant savings and protect your investment by insuring your home below replacement cost—browse options to find the best coverage that fits your needs.

Understanding Home Insurance and Replacement Cost

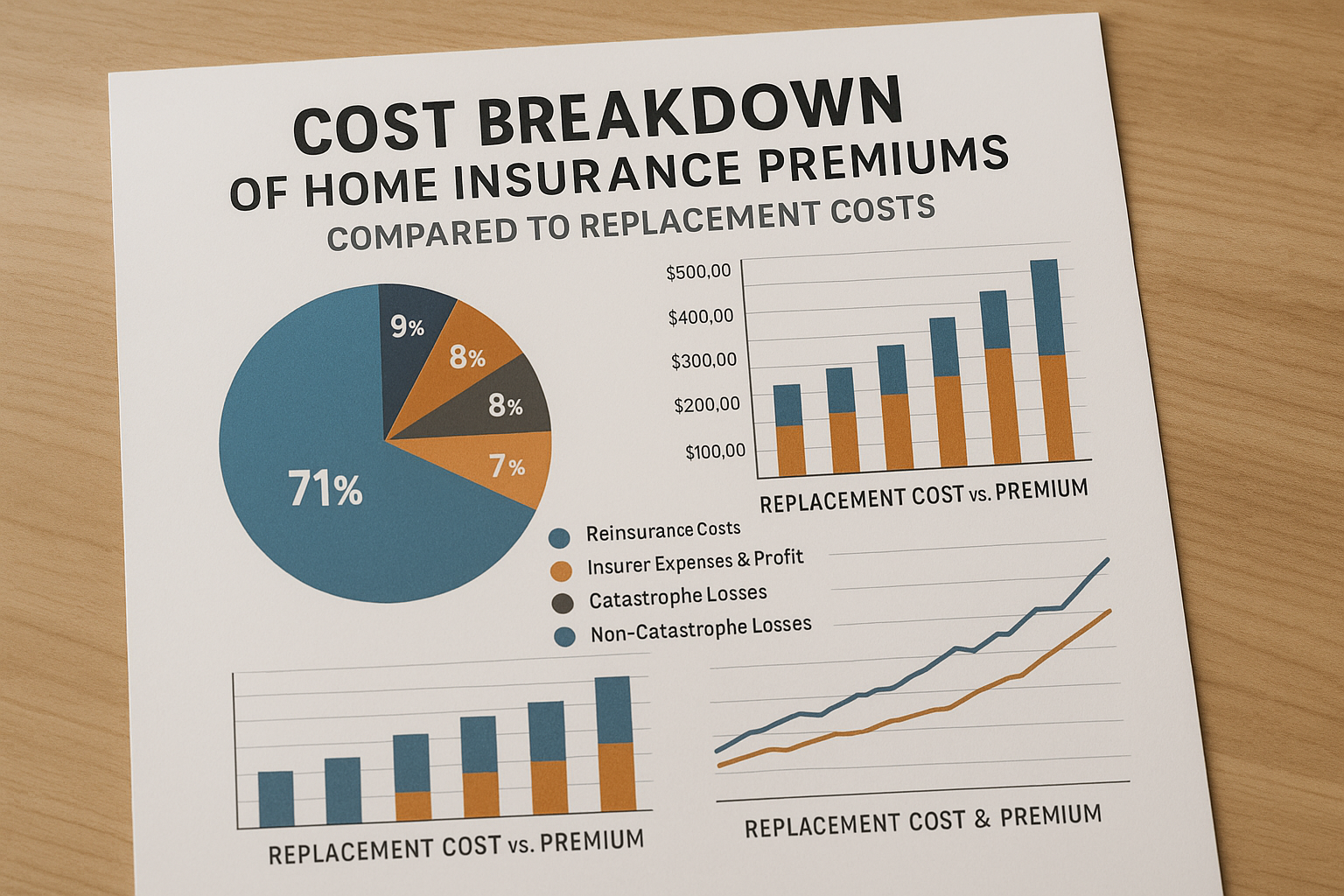

Home insurance is a crucial safety net, providing financial protection against unforeseen damages and losses. One of the key aspects of home insurance is the concept of replacement cost, which is the amount it would take to rebuild your home from the ground up, including materials and labor, at current prices. Insuring your home below its replacement cost might seem counterintuitive, but it can be a strategic move to save on premiums while still maintaining adequate coverage.

Why Insure Below Replacement Cost?

Insuring your home below replacement cost can lead to lower premiums, making it an attractive option for homeowners looking to cut costs. This strategy may be suitable if you have a robust emergency fund or alternative financial resources to cover potential gaps. Additionally, if your home is older or you plan to downsize in the future, reducing your insurance coverage could align better with your long-term financial goals.

How to Assess Your Home's Replacement Cost

Determining the replacement cost of your home involves evaluating current construction costs, including materials and labor. You can start by consulting a professional appraiser or using online calculators provided by insurance companies to get an estimate. This figure will help you understand the coverage you might need and the potential savings from insuring below this amount.

Potential Risks and Considerations

While insuring below replacement cost can save money, it comes with risks. If a catastrophic event occurs, you might face out-of-pocket expenses to cover the difference between your insurance payout and the actual rebuilding costs. It's important to weigh these risks against your financial situation and risk tolerance. Additionally, some mortgage lenders require you to carry insurance that covers the full replacement cost, so check your loan terms before making adjustments.

Finding the Right Insurance Plan

To find an insurance policy that fits your needs, compare plans from multiple providers. Look for those offering flexible coverage options that allow you to adjust the replacement cost coverage. Many insurers provide online tools to help you estimate your needs and customize your policy. As you browse options, pay attention to customer reviews and ratings to ensure you're choosing a reputable company.

Additional Strategies for Savings

Beyond insuring below replacement cost, consider other strategies to reduce your premiums. Bundling home and auto insurance, installing security systems, and increasing your deductible are common methods to lower costs. Additionally, maintaining a good credit score can positively impact your insurance rates, as insurers often use credit information to assess risk.

Real-World Examples

A study by the Insurance Information Institute found that homeowners who actively shop for insurance every few years can save up to $500 annually1. Furthermore, a report from the National Association of Insurance Commissioners highlights that understanding your policy and coverage limits can prevent costly surprises2.

Explore Your Options

As you consider insuring your home below replacement cost, take the time to explore various insurance options and resources available. Whether you're seeking a more affordable policy or looking to adjust your coverage, there are numerous strategies to optimize your insurance plan. Visit websites of reputable insurance providers to see these options and tailor a policy that aligns with your financial goals.