Why Washington Renters Are Saving Big on Insurance

Discover how you can cut down on your renter's insurance costs in Washington while exploring a variety of options that suit your needs and budget when you browse options available today.

Understanding the Washington Renter's Insurance Landscape

In recent years, Washington has become a hotspot for renters looking to save on insurance costs. The state's competitive insurance market, coupled with a growing awareness of the benefits of renter's insurance, has led to significant savings for many residents. As a renter, you may be wondering how these savings are possible and what steps you can take to capitalize on them.

Why Are Washington Renters Saving Big?

One of the primary reasons renters in Washington are enjoying lower insurance premiums is the competitive nature of the state's insurance market. With numerous providers offering tailored policies, renters have the advantage of shopping around for the best deals. This competition drives down prices, allowing you to find affordable coverage that still meets your needs.

Moreover, many insurance companies in Washington offer discounts for bundling policies. If you already have an auto insurance policy, for example, you might qualify for a discount by adding renter's insurance. These bundling options are a great way to save money while ensuring comprehensive coverage.

Real-World Savings and Discounts

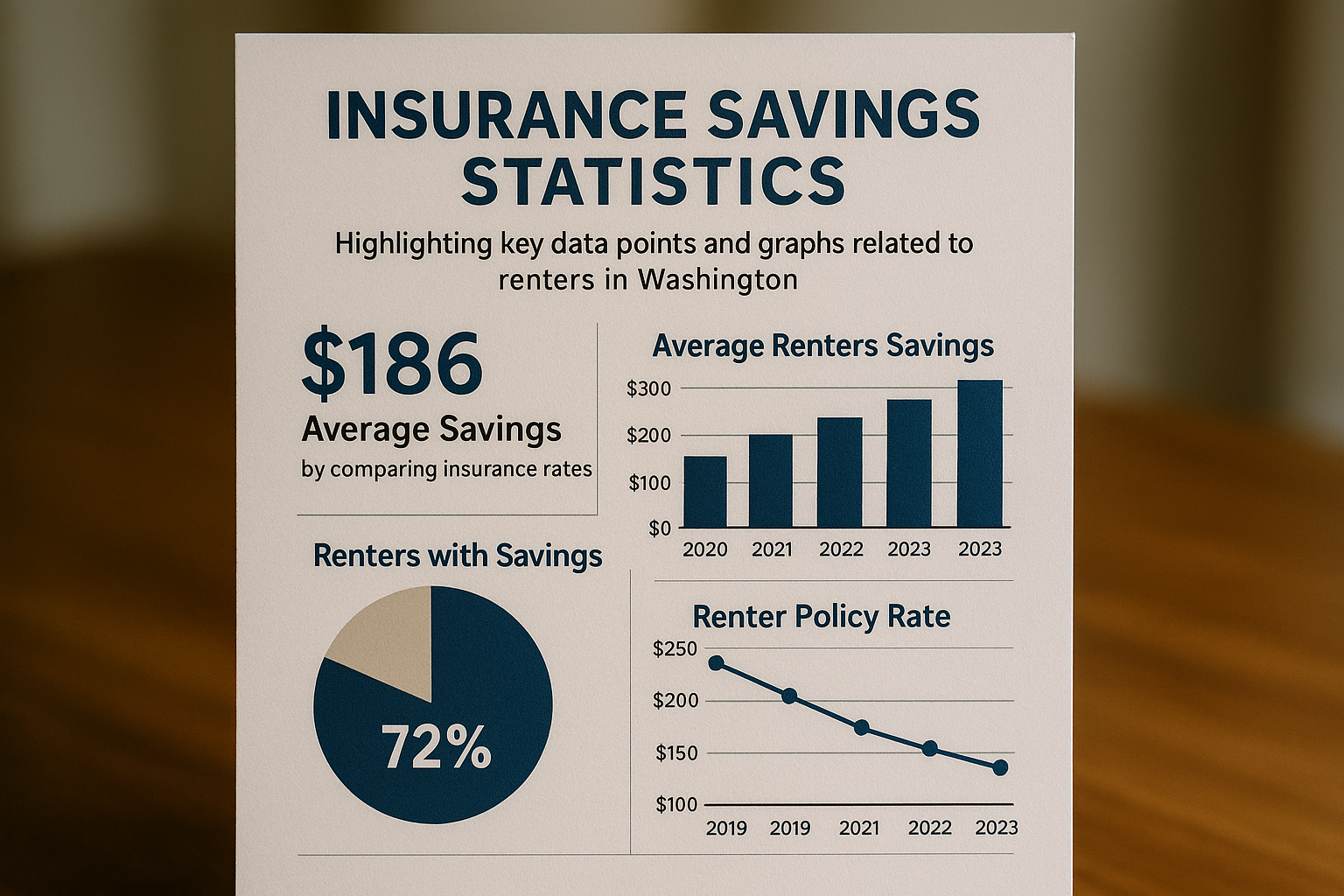

According to recent data, the average cost of renter's insurance in Washington is approximately $150 per year1. This figure is lower than the national average, making it an attractive option for budget-conscious renters. Additionally, many insurers offer discounts for installing safety features like smoke detectors, deadbolt locks, and security systems, further reducing your premiums.

For example, companies like State Farm and Allstate offer discounts for policyholders who meet specific safety criteria or have a claims-free history23. These savings can add up over time, making renter's insurance an even more cost-effective investment.

Exploring Your Options

To take full advantage of these savings, it's essential to explore the different insurance options available. Start by assessing your coverage needs and budget, then compare policies from various providers. Many companies offer online tools that allow you to customize your coverage and get instant quotes. By doing so, you can ensure that you're getting the best deal possible.

Additionally, consider reaching out to local insurance agents who can provide personalized advice and help you navigate the complexities of renter's insurance. Their expertise can be invaluable in finding a policy that offers both affordability and comprehensive protection.

Final Thoughts

With the right approach, Washington renters can significantly reduce their insurance costs while maintaining adequate coverage. By leveraging the competitive market, exploring bundling options, and taking advantage of available discounts, you can enjoy peace of mind without breaking the bank. As you browse options and explore the various policies on offer, remember that the right coverage is not just about saving money—it's about protecting your home and belongings.