Maximize Profits with Secret Automotive Investment Tips Today

Unlock the potential to boost your financial portfolio by exploring secret automotive investment tips that savvy investors are using today—browse options and discover the hidden opportunities that could accelerate your earnings.

The Growing Appeal of Automotive Investments

The automotive industry has long been a cornerstone of the global economy, offering diverse investment opportunities from manufacturing to technological advancements in electric vehicles. In recent years, the sector has experienced a significant transformation, driven by innovation and a shift towards sustainability. As an investor, this presents a unique chance to capitalize on emerging trends and maximize profits.

One of the most compelling areas of automotive investment is the electric vehicle (EV) market. With major automakers like Tesla, Ford, and General Motors committing to electrification, the EV sector is projected to grow exponentially. According to BloombergNEF, electric vehicles are expected to account for 58% of global passenger car sales by 20401. This shift not only provides investment opportunities in EV manufacturers but also in related industries such as battery production and charging infrastructure.

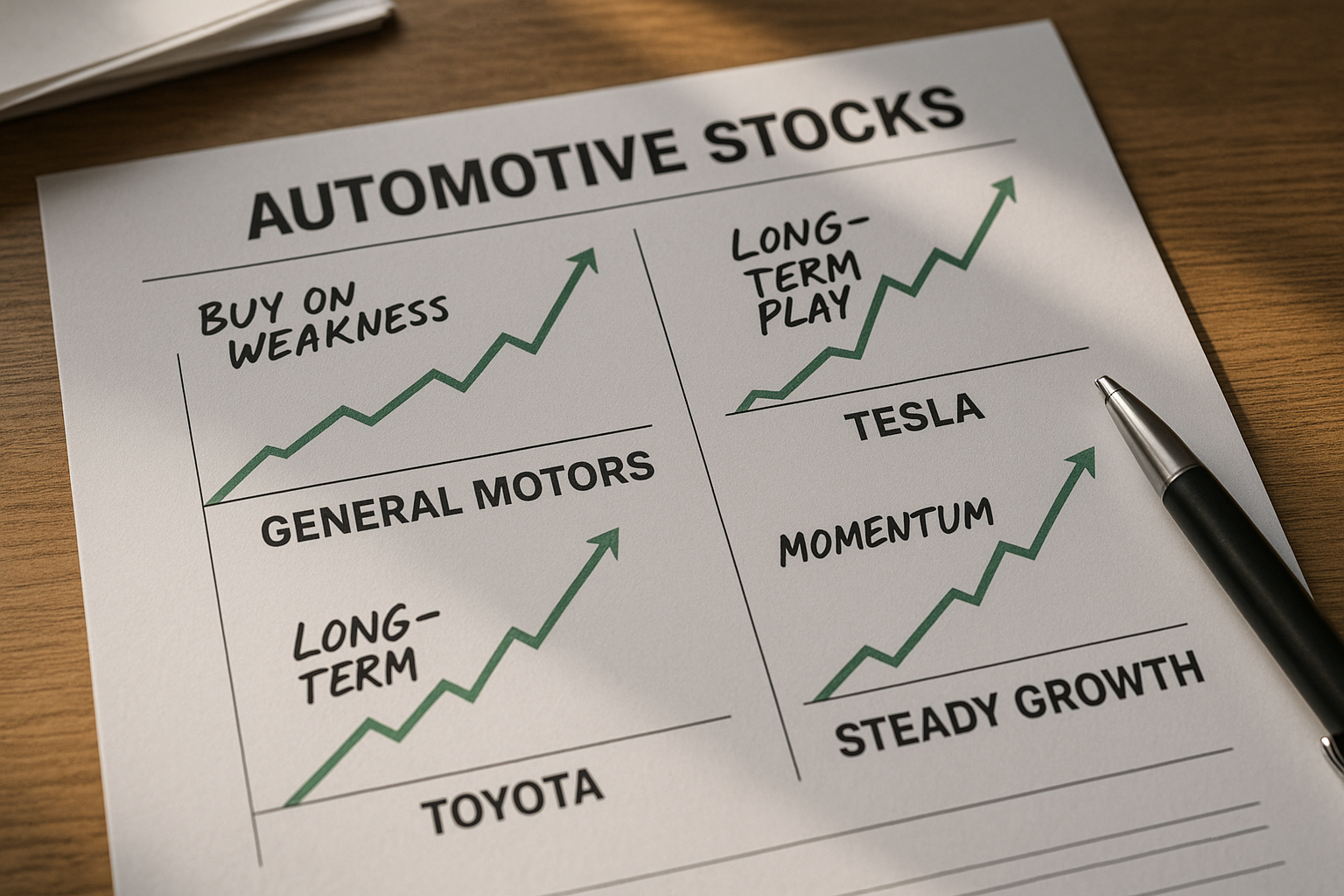

Investment Strategies for Maximizing Returns

To maximize profits in the automotive sector, it's crucial to adopt a strategic approach. Here are some key strategies to consider:

- Diversification: Spread your investments across various segments within the automotive industry. Consider investing in established car manufacturers, innovative startups, and companies involved in autonomous driving technologies.

- Focus on Technology: The integration of technology in vehicles is a major growth driver. Companies developing software for autonomous vehicles or advanced driver-assistance systems (ADAS) are poised for significant growth. Research firms like Waymo and Mobileye, which are at the forefront of these technologies, offer promising investment opportunities.

- Monitor Regulatory Changes: Government policies and regulations can heavily impact the automotive industry. Keep an eye on legislation related to emissions, safety standards, and incentives for electric vehicles, as these can influence market dynamics and investment returns.

Real-World Examples and Financial Insights

Investing in the automotive industry requires a keen understanding of market trends and financial insights. For instance, Tesla's stock surged over 700% in 2020, driven by its leadership in the EV market and strong financial performance2. Similarly, NIO, a Chinese electric vehicle manufacturer, saw its stock price increase by over 1,000% in the same year3.

Another example is the semiconductor industry, which plays a vital role in automotive technology. The global semiconductor shortage has highlighted the importance of this sector, leading to increased investments and strategic partnerships4. By investing in semiconductor companies, you can potentially benefit from the growing demand for chips in vehicles.

Exploring Specialized Investment Options

For those looking to delve deeper into automotive investments, specialized funds and exchange-traded funds (ETFs) offer a convenient way to gain exposure to the sector. Funds like the Global X Autonomous & Electric Vehicles ETF (DRIV) or the KraneShares Electric Vehicles & Future Mobility Index ETF (KARS) provide diversified portfolios focused on automotive innovation.

Additionally, visiting websites and following the options of financial advisors who specialize in automotive investments can offer tailored advice and insights into the best opportunities available. By leveraging expert guidance, you can make informed decisions and optimize your investment strategy.

The automotive industry presents a wealth of opportunities for investors seeking to maximize profits. By staying informed about market trends, adopting strategic investment approaches, and exploring specialized options, you can unlock the potential of this dynamic sector and accelerate your financial growth.