Find Hidden Savings with This Game-Changing Refinance Tool

Unlock the potential to save thousands by refinancing your mortgage with innovative tools designed to simplify your search and comparison process—browse options today to discover how much you could save.

Understanding the Refinance Landscape

Refinancing your mortgage can be a powerful financial strategy, allowing you to capitalize on lower interest rates, reduce monthly payments, or even shorten your loan term. However, navigating the myriad of refinancing options can be daunting. This is where a game-changing refinance tool comes in, streamlining the process and uncovering hidden savings that might otherwise go unnoticed.

How the Refinance Tool Works

This innovative tool aggregates data from multiple lenders, providing you with a comprehensive overview of the best available rates and terms based on your financial profile. By using advanced algorithms and real-time data, it ensures that you have access to the most competitive offers in the market. This means you can make informed decisions without the hassle of manually comparing countless options.

Benefits of Using a Refinance Tool

The primary advantage of using a refinance tool is the potential for significant cost savings. By securing a lower interest rate, you can reduce your monthly payments or pay off your mortgage faster, saving thousands over the life of the loan. Additionally, these tools often highlight special promotions or discounts that lenders may not advertise widely, giving you an edge in your search for the best deal1.

Furthermore, the convenience of having all the information you need in one place cannot be overstated. Instead of spending hours researching and contacting different lenders, you can simply input your details and let the tool do the work for you. This efficiency not only saves time but also reduces the stress associated with the refinancing process2.

Real-World Savings Examples

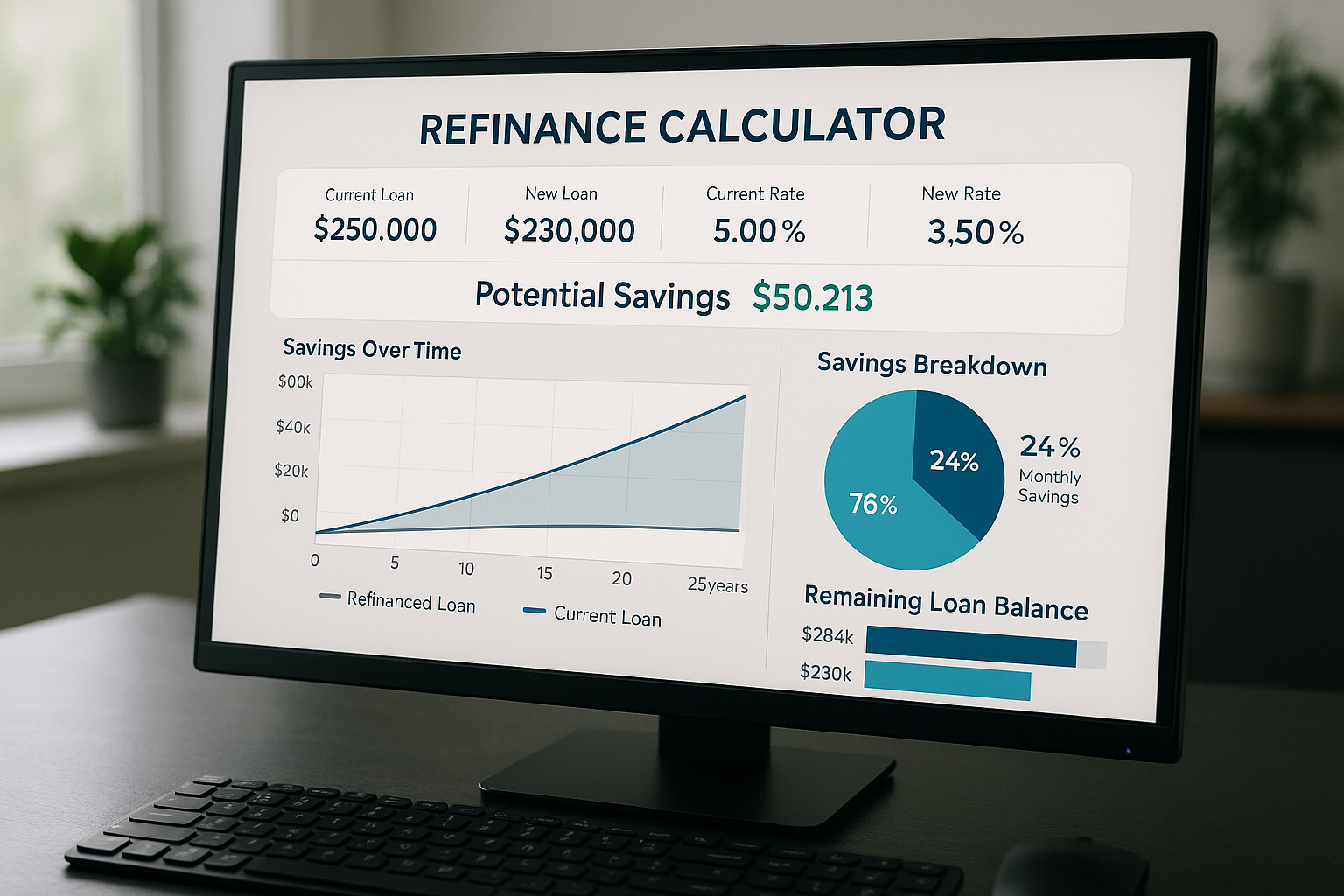

Consider the case of a homeowner with a $300,000 mortgage at a 4.5% interest rate. By refinancing to a 3.5% rate, they could save over $150 a month, totaling more than $54,000 in interest over a 30-year term3. Such savings can significantly impact your financial health, freeing up funds for other investments or expenses.

Exploring Specialized Refinance Options

Beyond traditional refinancing, there are specialized options available for those with unique financial needs. For instance, cash-out refinancing allows you to tap into your home's equity for large expenses, while rate-and-term refinancing focuses on adjusting your interest rate and loan duration. By using a refinance tool, you can easily compare these options and determine which aligns best with your financial goals4.

Leveraging a refinance tool can be a transformative step toward achieving financial freedom. By simplifying the process and revealing hidden savings, these tools empower you to make smarter financial decisions. As you explore the available resources and options, you'll be better equipped to secure a refinancing deal that maximizes your savings and aligns with your long-term objectives.