Mortgage Rates Secrets Everyone Overlooks Get Ready Now

If you're ready to unlock the hidden secrets of mortgage rates that could save you thousands, it's time to browse options and see these opportunities that many overlook.

Understanding Mortgage Rates: The Basics

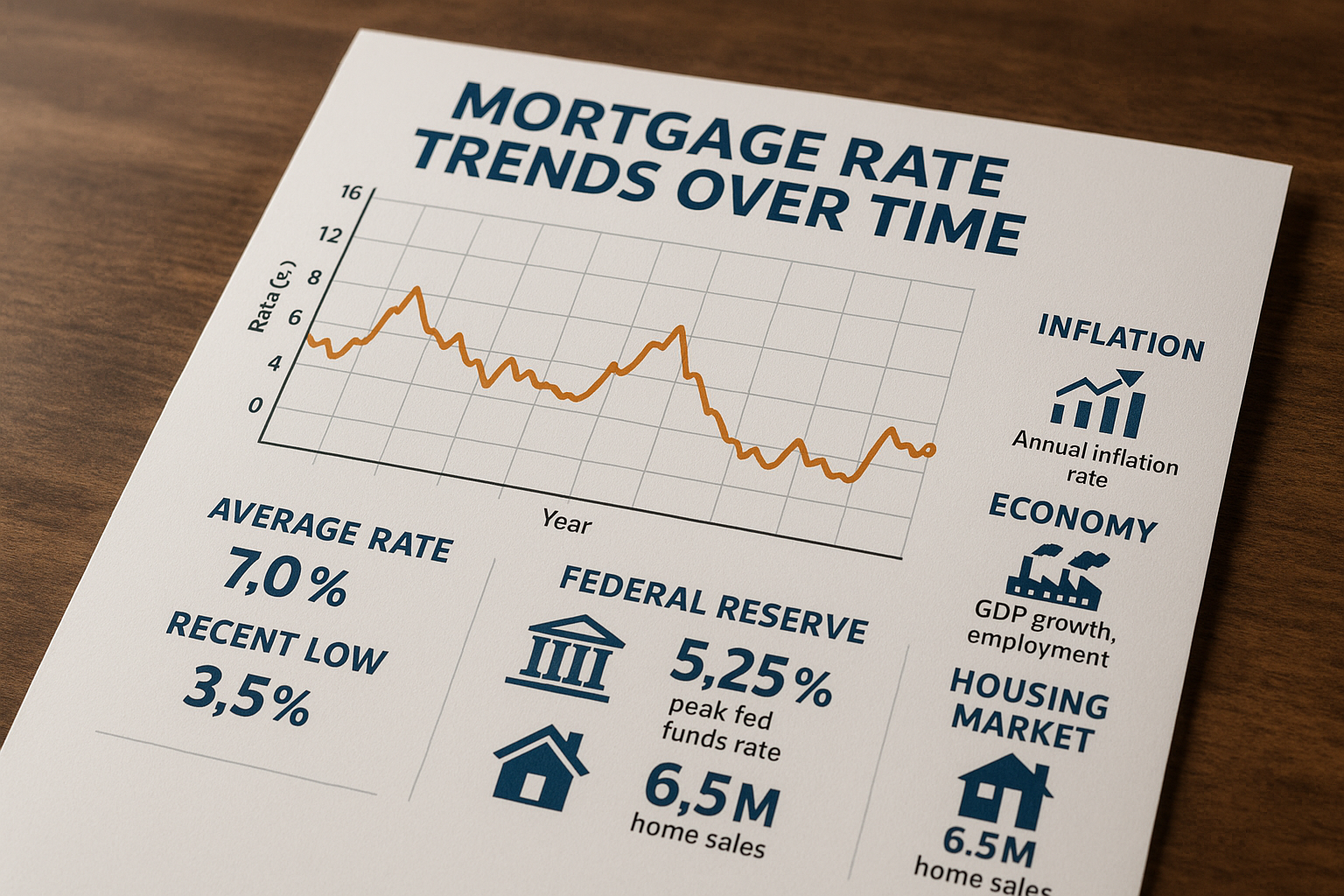

Mortgage rates are a crucial factor in determining the overall cost of your home loan. They are influenced by a variety of factors, including the economy, inflation, and the policies of the Federal Reserve. Essentially, a mortgage rate is the interest rate charged on a mortgage loan, and it can be fixed or variable. Fixed rates remain constant throughout the term of the loan, while variable rates can fluctuate based on market conditions.

The Hidden Factors Affecting Mortgage Rates

While many people focus on the visible aspects like credit scores and down payments, several overlooked factors can significantly impact mortgage rates. For instance, the type of property you are purchasing can influence the rate. Primary residences often have lower rates compared to investment properties, as lenders perceive them as less risky1.

Additionally, the loan-to-value ratio (LTV) is a critical factor that many overlook. A lower LTV can lead to better rates because it indicates a lower risk to the lender. Furthermore, economic indicators such as employment rates and GDP growth can also indirectly affect mortgage rates by influencing the overall lending environment2.

Strategies to Secure the Best Mortgage Rates

To take advantage of the best mortgage rates, consider the following strategies:

1. **Improve Your Credit Score**: A higher credit score can significantly reduce your interest rate. Paying off debts and maintaining a low credit utilization ratio are effective ways to boost your score3.

2. **Increase Your Down Payment**: Offering a larger down payment can lower your LTV ratio, which often results in more favorable rates.

3. **Compare Lenders**: Don't settle for the first offer you receive. Browse options and compare rates from different lenders to ensure you're getting the best deal possible.

4. **Consider Points**: Paying for mortgage points upfront can lower your interest rate over the life of the loan. This strategy can be beneficial if you plan to stay in your home for an extended period.

Real-World Examples and Data

In recent years, mortgage rates have fluctuated significantly due to economic conditions and policy changes. For instance, during the COVID-19 pandemic, rates reached historic lows as the Federal Reserve took measures to stimulate the economy4. This created an opportunity for many homeowners to refinance and reduce their monthly payments substantially.

Exploring Additional Resources

For those interested in delving deeper into mortgage rates, several online platforms offer tools and calculators to help you understand your options better. Websites like Bankrate and NerdWallet provide comprehensive guides and current rate comparisons that can be invaluable in your search for the best mortgage deal.

In summary, understanding the intricacies of mortgage rates and the factors that influence them can empower you to make informed decisions and potentially save thousands over the life of your loan. By staying informed and exploring the available options, you can secure a mortgage rate that aligns with your financial goals and circumstances.