Retire Comfortably Use Reverse Mortgages Smartly Now

Retiring comfortably is a dream for many, and by using reverse mortgages smartly, you can unlock the financial freedom to enjoy your golden years without the typical monetary constraints, so browse options and explore how these strategies can enhance your retirement lifestyle today.

Understanding Reverse Mortgages

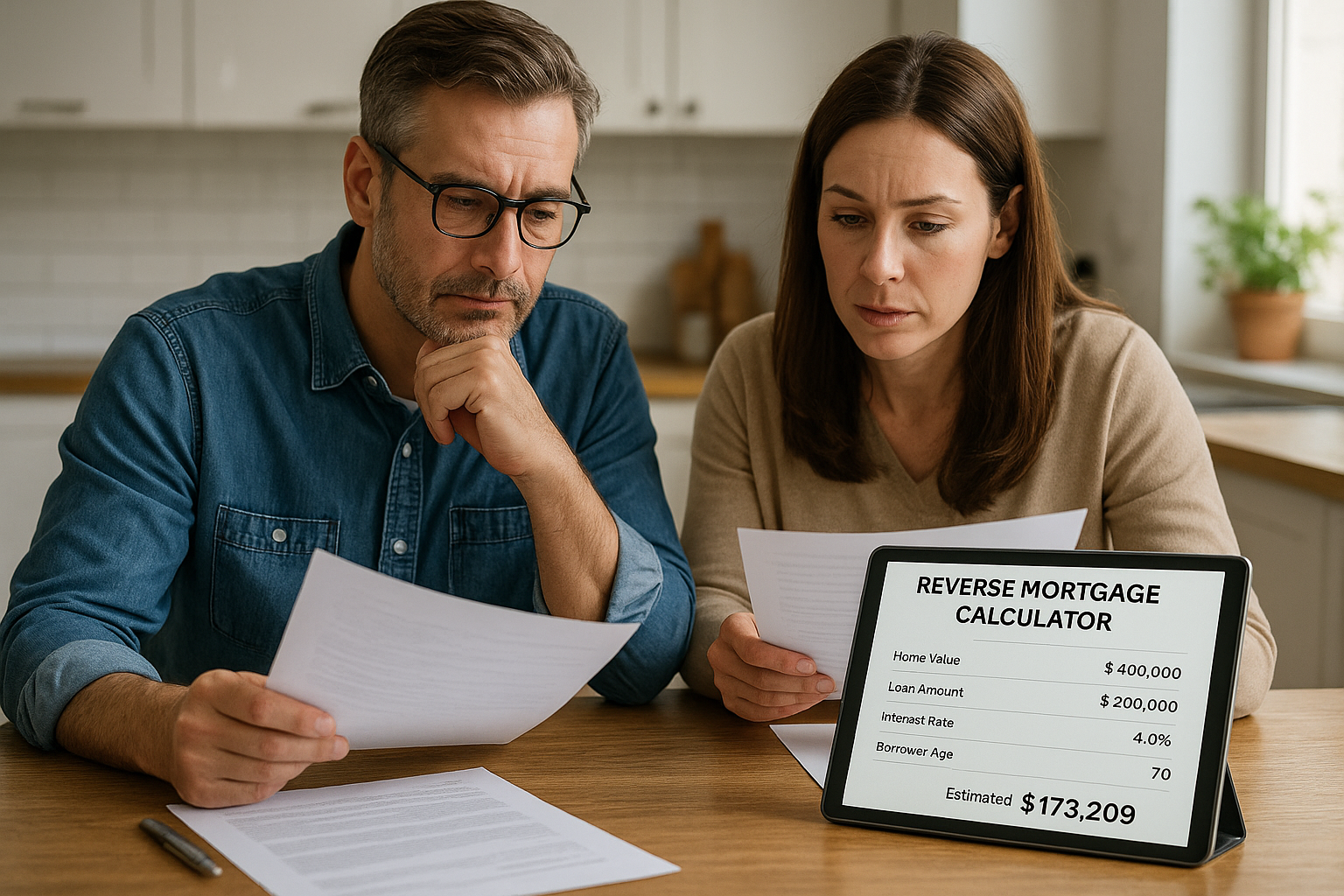

Reverse mortgages have become an increasingly popular financial tool for retirees looking to supplement their income. Unlike traditional mortgages where you make payments to a lender, a reverse mortgage allows you to receive payments, using your home equity as collateral. This can be particularly beneficial for those who have significant equity in their homes but are lacking in liquid assets. By converting part of your home equity into cash, you can cover living expenses, medical bills, or even travel, without having to sell your beloved home.

Types of Reverse Mortgages

There are primarily three types of reverse mortgages: Home Equity Conversion Mortgages (HECMs), proprietary reverse mortgages, and single-purpose reverse mortgages. HECMs are federally insured and the most common type, offering flexibility in how funds are received, such as a lump sum, monthly payments, or a line of credit. Proprietary reverse mortgages are private loans that cater to homeowners with high-value properties, while single-purpose reverse mortgages are typically offered by state or local governments for specific uses like home repairs or property taxes1.

Benefits of Reverse Mortgages

Reverse mortgages offer several advantages. They provide a steady income stream, which can be crucial for covering day-to-day expenses without depleting other retirement savings. Additionally, since the funds received are considered a loan advance, they are generally tax-free, allowing you to maximize your available cash2. Furthermore, you retain ownership of your home, and the loan is only repaid when you sell the house, move out permanently, or pass away.

Costs and Considerations

While reverse mortgages can be a great tool, they are not without costs. Fees can include origination fees, closing costs, and servicing fees, which can add up. It’s important to weigh these costs against the benefits and consider how they might affect your estate. Additionally, you must continue to pay property taxes, homeowners insurance, and maintain the home, as failing to do so could result in foreclosure3.

Real-World Applications

Many retirees have successfully used reverse mortgages to enhance their financial stability. For instance, some have used the funds to pay off existing mortgages, reducing monthly expenses significantly. Others have funded home renovations that allow them to age in place comfortably. In a volatile market, having a line of credit from a reverse mortgage can provide a financial cushion, ensuring that you don’t have to sell investments at a loss4.

Reverse mortgages can be a powerful tool for retirees seeking to improve their financial situation. By understanding the different types, benefits, and costs, you can make an informed decision that aligns with your retirement goals. With numerous options available, exploring specialized resources can help you find the best solution for your needs, ensuring a more secure and enjoyable retirement.