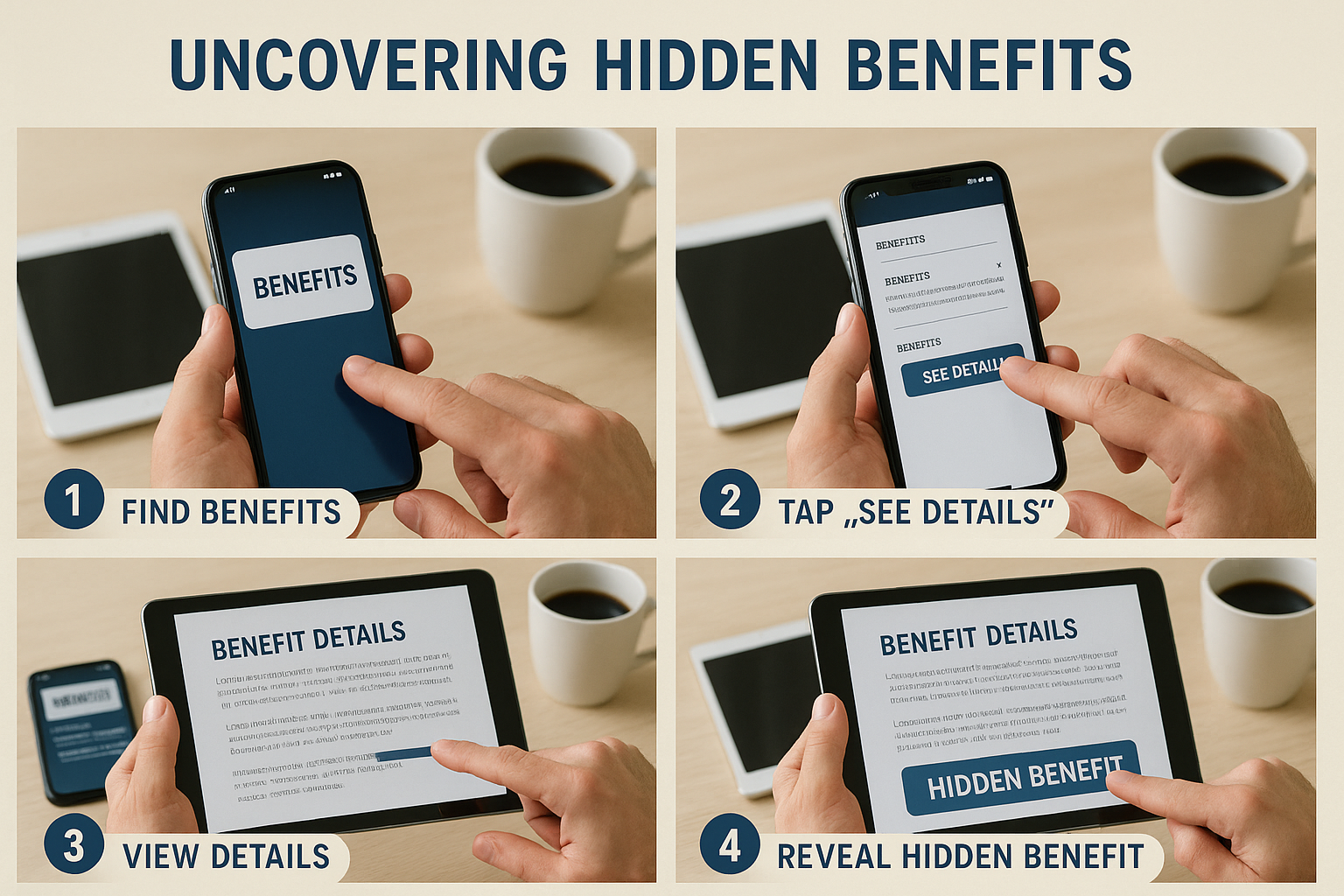

Claim Hidden Benefits with This Secret Hack Now

Unlock a world of hidden benefits waiting to be claimed by you, as you browse options and explore the myriad ways to maximize your resources today.

Understanding Hidden Benefits: What Are They?

In today's fast-paced world, many individuals and businesses overlook the potential advantages that lie just beneath the surface of their current circumstances. Hidden benefits refer to those often-unnoticed perks or advantages that can significantly improve your financial situation, lifestyle, or business operations. These can range from unclaimed tax credits and rebates to lesser-known employee benefits or business expense deductions. By taking the time to search options and identify these hidden gems, you can unlock substantial savings and opportunities for growth.

How to Identify and Claim Hidden Benefits

The first step in claiming hidden benefits is to conduct a thorough review of your current financial and personal situation. This can involve examining your employee benefits package, reviewing past tax returns, or assessing your business expenses. Many people find that they have overlooked significant savings simply because they were unaware of the options available to them.

For individuals, one of the most common areas where hidden benefits can be found is in employee benefits packages. Many companies offer a range of perks beyond salary, including health savings accounts (HSAs), flexible spending accounts (FSAs), and retirement plan contributions. By understanding and utilizing these options, employees can often save money and reduce taxable income1.

Businesses, on the other hand, can benefit from exploring tax deductions and credits that they might not be fully utilizing. For example, the Research & Development Tax Credit is often overlooked by small businesses, yet it can provide significant savings for those involved in innovation and development2.

Real-World Examples and Data

Consider the case of a mid-sized company that discovered it was eligible for a Work Opportunity Tax Credit (WOTC) after hiring veterans and individuals from targeted groups. By claiming this credit, the company was able to reduce its tax liability significantly, enhancing its bottom line3.

Similarly, individuals who take the time to review their health insurance plans may find that they are eligible for wellness incentives or rewards programs that can cover the cost of gym memberships or other health-related expenses. These programs not only promote healthier lifestyles but also offer financial benefits4.

Exploring Further Opportunities

For those eager to delve deeper into the world of hidden benefits, there are numerous resources and services available to assist in identifying and claiming these opportunities. Financial advisors and tax professionals can provide personalized guidance tailored to your specific situation, ensuring that you don't leave any potential benefits unclaimed.

Additionally, many online platforms offer tools and calculators to help you assess your eligibility for various credits and deductions. By visiting websites that specialize in financial planning or tax optimization, you can gain valuable insights and strategies to enhance your financial well-being.

By taking proactive steps to uncover and claim hidden benefits, you can significantly improve your financial health and overall quality of life. Whether you're an individual looking to maximize your employee benefits or a business seeking to reduce tax liabilities, the key is to remain informed and proactive. As you explore these options, remember that the potential for savings and growth is vast—waiting for you to seize the opportunity.