Access Secret Private Health Insurance Plans Today

If you're seeking to unlock exclusive health insurance benefits that could transform your healthcare experience, now is the time to browse options and see these opportunities that might be just what you need.

Understanding Private Health Insurance Plans

Private health insurance plans offer a range of benefits that can significantly enhance your healthcare coverage beyond what public plans typically provide. These plans are designed to cater to individual needs, offering flexibility in terms of coverage options and provider networks. Unlike public insurance, private plans often allow you to choose from a wider array of doctors and specialists, ensuring that you receive the best possible care tailored to your health requirements.

Types of Private Health Insurance Plans

Private health insurance plans come in various forms, each with unique features and benefits. The most common types include:

- Health Maintenance Organizations (HMOs): These plans require members to choose a primary care physician and obtain referrals for specialist care. They often have lower premiums and out-of-pocket costs.

- Preferred Provider Organizations (PPOs): Offering more flexibility, PPOs allow you to see any healthcare provider but offer better rates for using in-network professionals. They typically have higher premiums but provide broader access to specialists.

- Exclusive Provider Organizations (EPOs): Similar to PPOs but with a more limited network of doctors and hospitals. EPOs usually require members to use in-network providers for all non-emergency care.

- Point of Service (POS) Plans: Combining features of HMOs and PPOs, POS plans require a primary care physician referral for specialist services but offer some out-of-network coverage at a higher cost.

Benefits of Private Health Insurance

The primary advantage of private health insurance is the ability to access a broader range of healthcare services and providers. With private plans, you often receive:

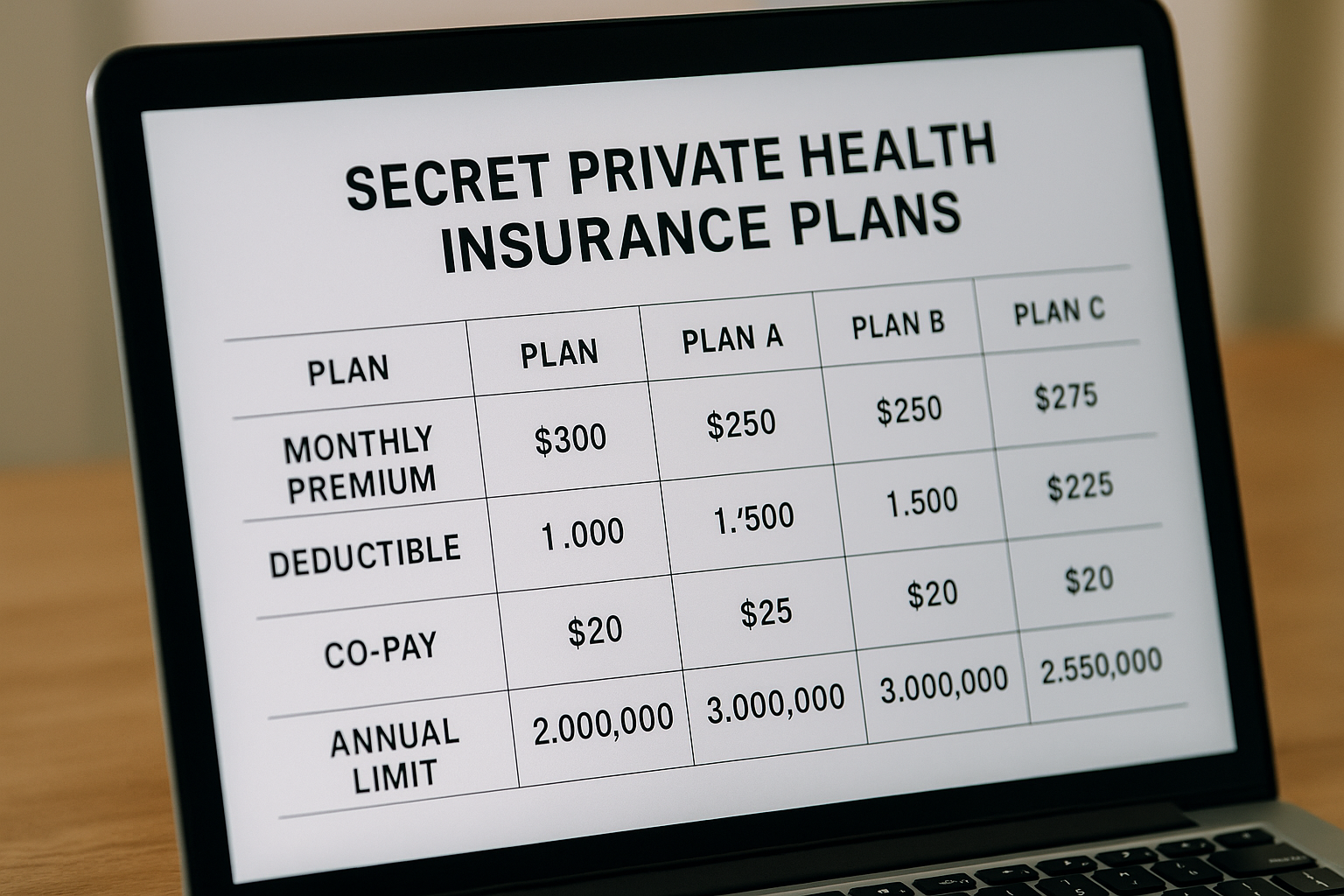

Financial Considerations

While private health insurance plans can offer superior coverage, they also come with varying costs. Premiums are typically higher than public insurance, but the investment can be worthwhile for those seeking specific healthcare services or faster access to treatment. According to recent data, the average annual premium for private health insurance in the United States was approximately $7,739 for single coverage and $22,221 for family coverage in 20231.

Exploring Your Options

To make the most informed decision, it's crucial to research and compare different private health insurance plans. Many online platforms allow you to search options and compare plans based on your specific needs and budget. Additionally, consulting with an insurance broker can provide personalized advice and help you navigate the complexities of health insurance policies.

Additional Resources

For those eager to delve deeper into private health insurance possibilities, numerous resources are available online. Websites like Healthcare.gov and private insurance providers offer detailed information on plan specifics, costs, and coverage options. As you explore these resources, consider your healthcare priorities and financial situation to choose a plan that best suits your needs.

Private health insurance plans present a valuable opportunity for individuals seeking enhanced healthcare coverage and flexibility. By taking the time to explore and compare different options, you can find a plan that aligns with your health needs and financial goals, ensuring peace of mind and access to quality care.