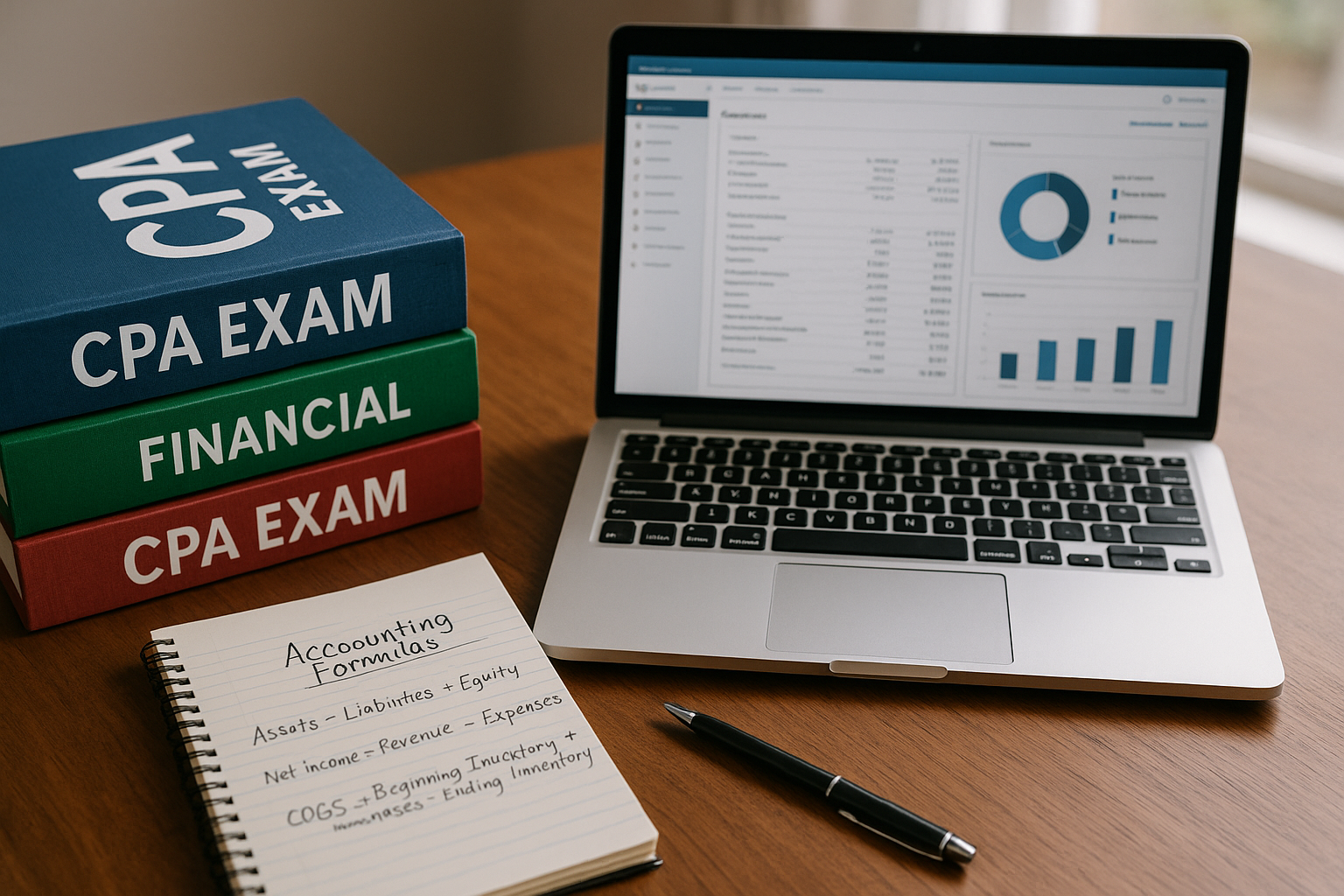

Achieve Your CPA Dreams Faster With Business Accounting

Achieving your CPA dreams faster is within reach when you explore and leverage the opportunities in business accounting, so browse options and see how you can streamline your path to success.

Understanding the CPA Pathway

Becoming a Certified Public Accountant (CPA) is a prestigious milestone in the accounting profession, offering significant career advancement and earning potential. The CPA designation is recognized globally as a symbol of excellence and expertise in accounting and finance. To achieve this status, candidates must meet specific educational requirements, pass a rigorous four-part exam, and gain relevant work experience. While the journey may seem daunting, focusing on business accounting can expedite the process by providing you with the necessary skills and knowledge.

Why Business Accounting?

Business accounting is a specialized area that deals with the financial aspects of managing a company. It encompasses a range of activities, including financial reporting, auditing, tax preparation, and strategic financial planning. By specializing in business accounting, you gain a comprehensive understanding of the financial operations within a business, which is invaluable when preparing for the CPA exam. This specialization not only equips you with practical skills but also enhances your ability to interpret complex financial data, a critical component of the CPA curriculum.

Career Opportunities and Earnings

The demand for CPAs with a background in business accounting is robust, offering numerous career opportunities across various industries. CPAs are often sought after for roles such as financial analysts, auditors, tax consultants, and chief financial officers. According to the U.S. Bureau of Labor Statistics, the median annual wage for accountants and auditors was $77,250 in 2021, with higher earnings potential for those holding a CPA license1. Specialized knowledge in business accounting can further enhance your earning potential and career prospects.

Cost and Investment

Pursuing a CPA designation requires an investment in education and exam preparation. Costs can vary, but candidates typically spend between $1,500 to $3,000 on CPA review courses, which are essential for passing the exam2. Additionally, there are fees for the exam itself, which can range from $1,000 to $1,500 depending on the state3. While these costs may seem significant, the return on investment is substantial, as CPAs often earn significantly more than their non-certified counterparts.

Leveraging Resources and Options

To maximize your success, it's crucial to utilize available resources and explore specialized options tailored to CPA candidates. Numerous online platforms offer comprehensive CPA review courses, practice exams, and study materials. Websites like Becker and Wiley provide structured study plans and expert guidance, ensuring you are well-prepared for the exam4. Additionally, many employers offer tuition reimbursement or financial assistance for CPA exam preparation, so it's worth inquiring about these benefits.

Pursuing your CPA dreams through business accounting not only accelerates your journey but also enhances your professional capabilities. By specializing in this field, you position yourself for success in a competitive job market, with the potential for higher earnings and career growth. As you navigate this path, remember to browse options and explore the resources available to make informed decisions that align with your career goals.