Auto Loan Refinance Rates Slashed for Savvy Drivers

As a savvy driver eager to reduce your monthly expenses, exploring the current trend of slashed auto loan refinance rates can unlock significant savings, so why not browse options now to see how you can benefit?

Understanding Auto Loan Refinancing

Auto loan refinancing involves replacing your existing car loan with a new one, typically at a lower interest rate. This financial strategy can lead to reduced monthly payments, decreased interest over the loan term, and even a shorter payoff period. For many, refinancing is a practical way to improve cash flow and manage finances more effectively.

Why Refinance Now?

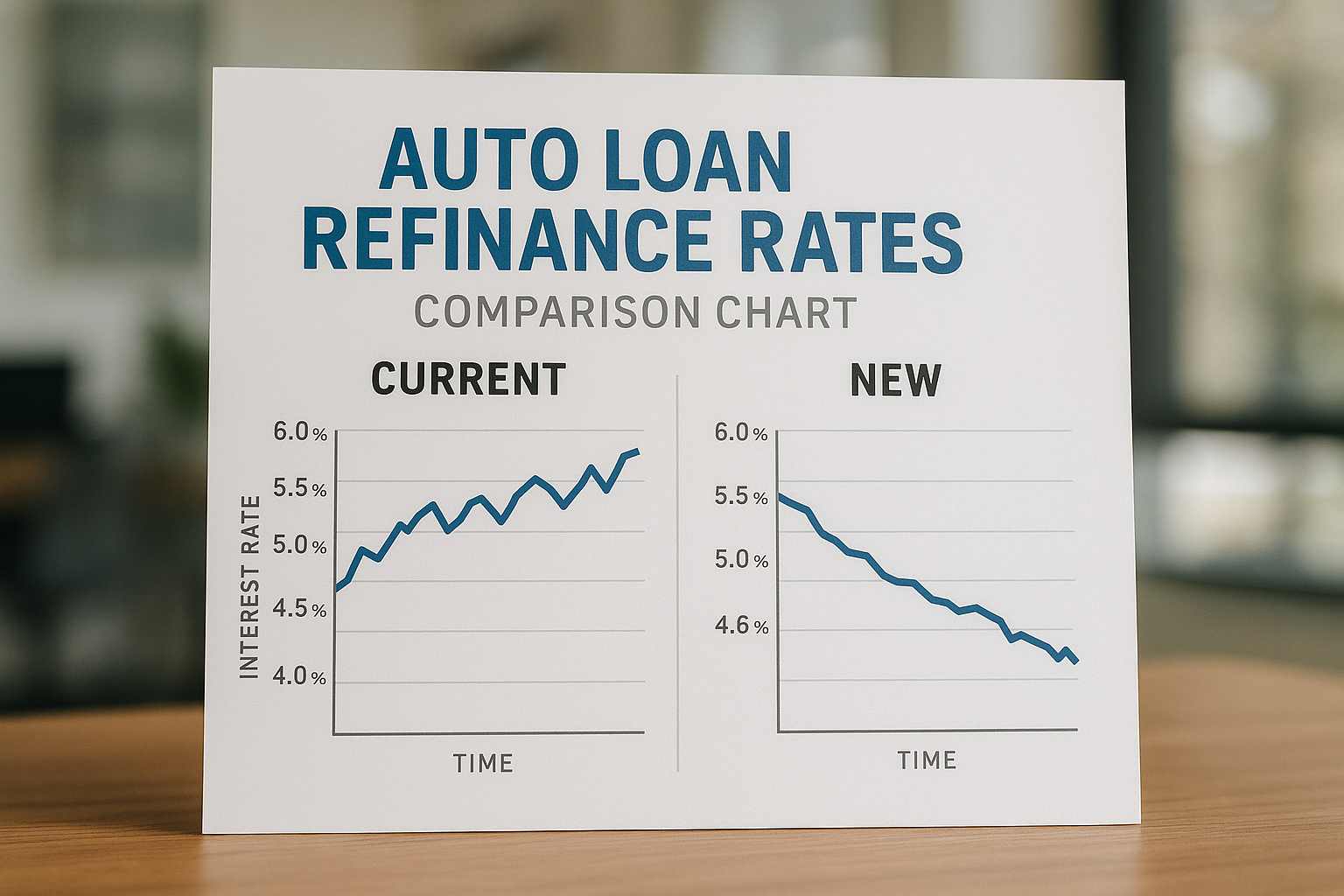

The current economic climate has seen a shift in interest rates, with many lenders offering competitive refinancing options to attract new customers. By taking advantage of these lower rates, you can reduce your overall loan cost. For instance, if your original loan was secured when rates were higher, refinancing now could significantly lower your monthly payments and total interest paid over the life of the loan.

Potential Savings and Benefits

Refinancing your auto loan can offer several financial benefits. Suppose you have a $20,000 loan at a 6% interest rate. By refinancing to a 4% rate, you could save over $1,000 in interest over a five-year term1. Additionally, a lower interest rate can mean more manageable monthly payments, freeing up cash for other expenses or savings.

How to Qualify for the Best Rates

To secure the best refinancing rates, it's crucial to maintain a strong credit score and a positive payment history on your current loan. Lenders typically offer their most competitive rates to borrowers with excellent credit. It's also wise to shop around and compare offers from different lenders. By visiting websites of various financial institutions, you can find the best deal tailored to your needs.

The Refinancing Process

The process of refinancing an auto loan is relatively straightforward. Start by gathering all necessary documents, such as proof of income, your current loan statement, and vehicle information. Next, apply for pre-approval with several lenders to compare rates and terms. Once you've selected the best offer, the new lender will pay off your existing loan, and you'll begin making payments on the new loan.

Considerations Before Refinancing

While refinancing can offer substantial benefits, it's essential to consider potential downsides. Some lenders may charge fees for early loan payoff or for processing the refinance. Ensure that the savings from a lower interest rate outweigh any costs associated with refinancing. Additionally, extending the loan term could lead to paying more interest over time, even with a lower rate.

The current trend of reduced auto loan refinance rates presents a valuable opportunity for drivers to lower their financial burden. By understanding the refinancing process, comparing offers, and leveraging your creditworthiness, you can optimize your auto loan to better suit your financial goals. Don't hesitate to explore the options available today and make the most of this favorable market condition.