Crime Insurance Wins Home Health Agencies Can't Ignore

Crime insurance is a crucial safeguard for home health agencies like yours, offering peace of mind and financial protection against potential employee dishonesty or theft, so why not browse options that can secure your business today?

Understanding Crime Insurance for Home Health Agencies

Crime insurance is designed to protect businesses from financial losses due to crimes such as theft, fraud, and employee dishonesty. For home health agencies, where employees often work unsupervised in clients' homes, this type of insurance is particularly vital. It provides a safety net against the risk of employees stealing from clients or the agency itself, which can lead to significant financial and reputational damage.

Key Benefits of Crime Insurance

Crime insurance offers several benefits that are indispensable for home health agencies:

1. **Financial Protection**: Crime insurance covers losses resulting from various criminal acts, including embezzlement, forgery, and theft. This ensures that your agency can recover financially from incidents that might otherwise be devastating.

2. **Reputation Management**: In the event of a crime, having insurance can help manage the fallout by providing resources for public relations efforts to restore your agency's reputation.

3. **Employee Confidence**: Knowing that your agency is protected can boost employee morale, as it demonstrates that you take the security of your business and clients seriously.

4. **Client Assurance**: Offering crime insurance coverage can be a selling point for potential clients, assuring them that their property and personal information are secure.

Real-World Examples

Consider a situation where an employee of a home health agency is found to have stolen valuables from a client's home. Without crime insurance, the agency might face legal action and be responsible for compensating the client out of pocket. However, with the right insurance policy, the financial burden is significantly reduced, allowing the agency to address the issue without crippling financial consequences1.

Cost Considerations

The cost of crime insurance varies based on several factors, including the size of the agency, the number of employees, and the level of coverage required. On average, small to medium-sized businesses can expect to pay between $500 and $2,000 annually for a policy that provides comprehensive coverage2.

Exploring Your Options

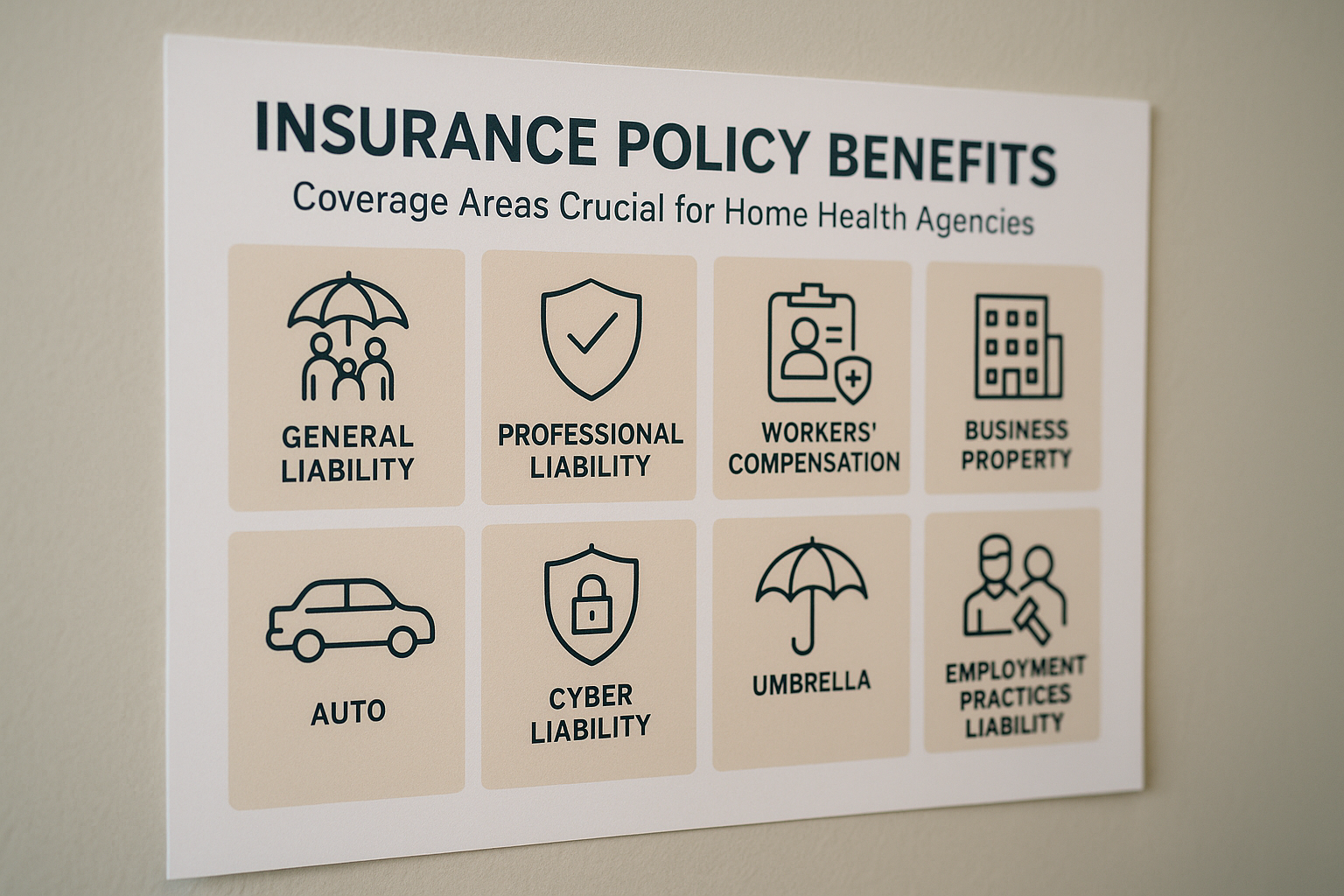

When searching for the right crime insurance policy, it's essential to compare different providers and coverage options. Many insurers offer tailored policies specifically for home health agencies, which can include additional protections such as cyber liability insurance. By visiting websites and exploring these specialized options, you can find a policy that best fits your agency's needs and budget3.

Taking Action

Implementing crime insurance is a proactive step that can save your home health agency from significant financial and reputational harm. By exploring your options and selecting a policy that aligns with your specific needs, you can ensure that your business is well-protected against potential threats.

In the ever-evolving landscape of home health care, safeguarding your agency with crime insurance is not just a wise investment—it's a necessity. By taking the time to see these options and secure the right coverage, you can focus on providing exceptional care to your clients with peace of mind.