Dominate Risk Savings with Smart Cyber Liability Renewal

If you're looking to safeguard your business while maximizing savings, it's time to explore smart cyber liability renewal options that offer both protection and financial efficiency—browse options now to ensure you're not missing out on valuable insights.

Understanding Cyber Liability Insurance

Cyber liability insurance is an essential safeguard for businesses in today's digital age. It provides coverage against data breaches, cyberattacks, and other digital threats that can have significant financial and reputational impacts. As cyber threats become more sophisticated, businesses must ensure their cyber liability policies are up-to-date and robust enough to handle emerging risks.

The Importance of Renewal

Renewing your cyber liability insurance is not just a routine task; it's a strategic opportunity to reassess your coverage needs and explore potential cost savings. Insurance companies often update their policies to reflect new risks and regulatory changes, which can impact coverage and premiums. By actively engaging in the renewal process, you can negotiate better terms, adjust coverage limits, and potentially reduce premiums.

Strategies for Smart Renewal

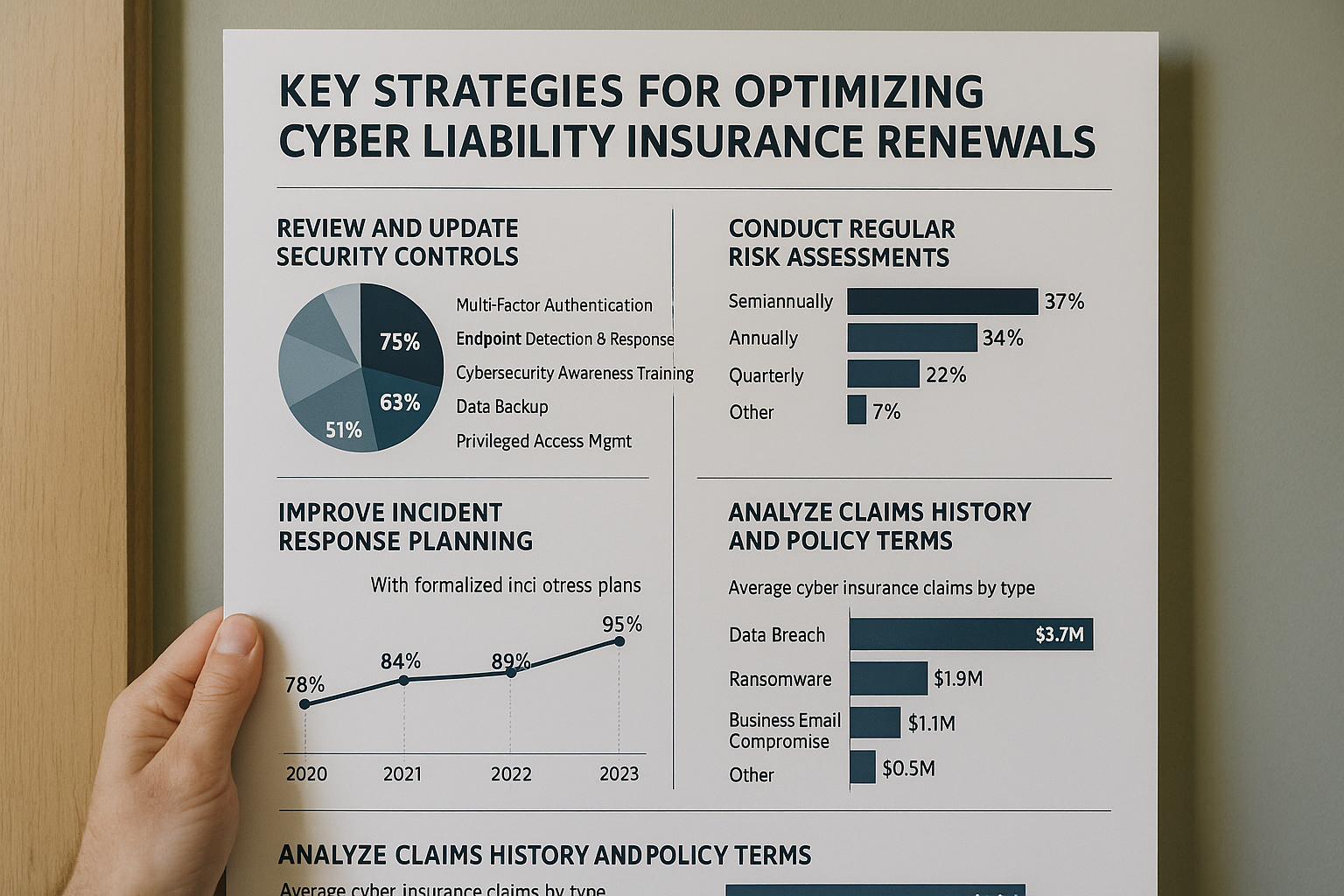

1. **Conduct a Risk Assessment**: Before renewal, perform a comprehensive risk assessment to identify any new vulnerabilities or changes in your business operations. This will help you determine the appropriate level of coverage needed.

2. **Compare Policies**: Don't settle for the first renewal offer you receive. Browse options from different insurers to compare coverage details and premiums. Many insurers offer competitive rates or discounts for new customers or businesses that demonstrate strong cybersecurity practices.

3. **Negotiate Terms**: Engage with your insurer to negotiate terms that better align with your current risk profile. This could include adjusting deductibles, coverage limits, or adding endorsements for specific risks.

4. **Leverage Technology**: Implementing advanced cybersecurity measures can lead to lower premiums. Insurers often provide discounts to businesses that use firewalls, encryption, and other security technologies.

Real-World Benefits

Businesses that actively manage their cyber liability renewals often see tangible benefits. For instance, a mid-sized company that implemented a comprehensive cybersecurity program reported a 15% decrease in their renewal premium1. Additionally, companies that bundle cyber liability with other insurance products, such as general liability or property insurance, can often secure further discounts.

Financial Context and Pricing

The cost of cyber liability insurance varies based on factors such as industry, company size, and coverage limits. On average, small businesses can expect to pay between $1,000 and $7,500 annually2. However, actively managing the renewal process can lead to significant savings. For example, businesses that enhance their cybersecurity measures may qualify for premium reductions of up to 20%3.

Explore Specialized Solutions

For businesses seeking tailored solutions, specialized cyber liability policies are available that address unique industry needs. Whether you're in healthcare, finance, or retail, there are policies designed to cover sector-specific risks. Visiting websites of leading insurers can provide insights into these specialized options and help you find a policy that aligns with your specific requirements.

By taking a proactive approach to your cyber liability renewal, you can not only enhance your business's protection against cyber threats but also optimize your insurance costs. Remember to explore the available options and leverage the competitive landscape to secure the best possible deal for your business.