Find Hidden Gems in Payroll Services Pricing Today

Unlocking the secrets of payroll services pricing can save you money and enhance your business's efficiency, so take a moment to browse options and discover hidden gems that could transform your company's financial operations.

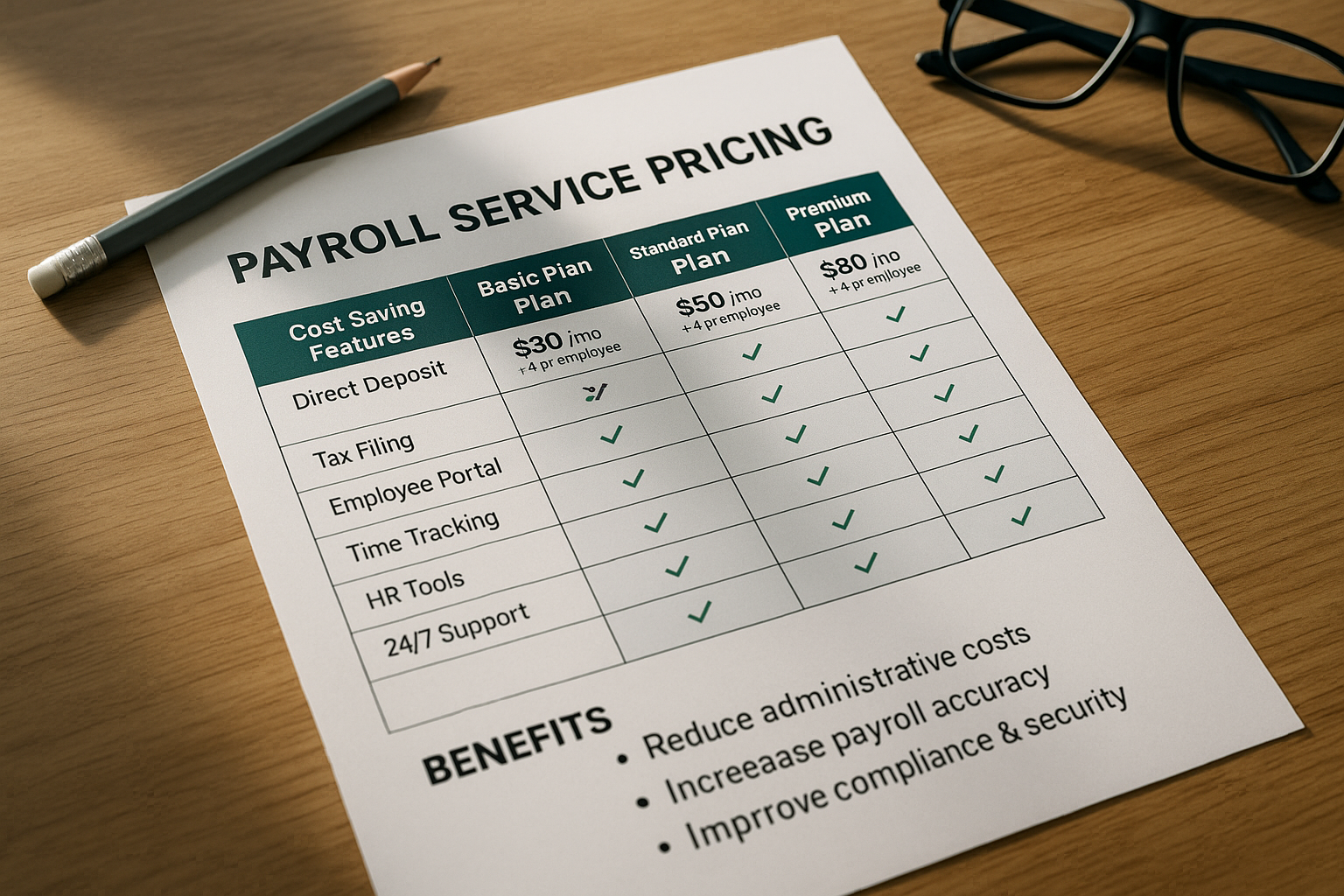

Understanding Payroll Services Pricing

Navigating the world of payroll services can be daunting, especially when it comes to understanding the pricing structures. Many businesses overlook the potential savings and benefits that can be found by delving deeper into the costs associated with these services. Payroll services typically charge based on a combination of factors, including the number of employees, the frequency of payroll runs, and additional features like tax filing or direct deposit options1.

Types of Payroll Services

Payroll services can be broadly categorized into three types: basic payroll processing, full-service payroll, and online payroll services. Basic payroll processing usually includes calculating wages and deductions, while full-service payroll encompasses tax filing, compliance, and human resources support. Online payroll services offer flexibility and convenience, allowing businesses to manage payroll from anywhere with an internet connection2.

Hidden Costs and Savings

While the base price of payroll services might seem straightforward, hidden costs can add up quickly. These can include charges for tax filing, year-end reporting, and even customer support. However, many payroll providers offer discounts for annual subscriptions or bundled services, which can significantly reduce costs. For instance, some providers offer up to 20% off for businesses that opt for annual billing rather than monthly payments3.

Real-World Examples

Consider a small business with 50 employees. By choosing a basic payroll service, the company might pay around $2,000 annually. However, by opting for a full-service package that includes tax filing and HR support, the cost could rise to $5,000 per year. Despite the higher cost, the comprehensive service can save time and reduce errors, ultimately providing a better return on investment4.

Evaluating the Benefits

The benefits of investing in a quality payroll service extend beyond mere cost savings. Efficient payroll management can improve employee satisfaction, reduce compliance risks, and free up valuable time for business owners to focus on growth strategies. Additionally, many payroll services offer integration with other business systems, such as accounting software, which can streamline operations and enhance data accuracy5.

Exploring Specialized Solutions

For businesses with unique needs, specialized payroll solutions can offer tailored services that cater to specific industries or business sizes. It's worth exploring these options, as they often provide features that are not available with generic payroll services. Whether you need multi-state tax filing, international payroll capabilities, or advanced reporting features, there's likely a solution that fits your requirements.

Taking the time to understand and explore payroll services pricing can reveal significant opportunities for cost savings and operational improvements. By assessing your business's specific needs and browsing the available options, you can uncover the hidden gems that will enhance your payroll management and contribute to your company's success.