Home Health Agency Insurance Policies That Save Thousands Instantly

Looking to protect your home health agency while saving thousands? Discover how the right insurance policies can provide you with peace of mind and significant financial benefits, and explore options that could transform your business today.

Understanding Home Health Agency Insurance

Running a home health agency involves numerous responsibilities, not least of which is ensuring you have the right insurance coverage. This is crucial not only for legal compliance but also for protecting your business from potential financial losses. Home health agency insurance typically includes several types of coverage, such as general liability, professional liability, and workers' compensation, each tailored to shield your agency from specific risks.

The Financial Benefits of Comprehensive Coverage

Investing in comprehensive insurance coverage for your home health agency can result in substantial savings over time. By mitigating risks associated with lawsuits, employee injuries, and property damage, you can avoid unexpected expenses that could otherwise drain your resources. Moreover, many insurance providers offer discounts for bundling multiple policies, which can further reduce your costs1.

Key Types of Insurance for Home Health Agencies

1. **General Liability Insurance**: This protects against claims of bodily injury or property damage that occur on your premises. For example, if a client slips and falls during a home visit, this policy can cover medical expenses and legal fees2.

2. **Professional Liability Insurance**: Also known as malpractice insurance, this covers claims of negligence or errors in the services provided by your agency. Given the critical nature of healthcare services, this is an essential policy for any home health agency3.

3. **Workers' Compensation Insurance**: This is mandatory in most states and covers medical expenses and lost wages for employees who are injured on the job. Ensuring you have this coverage can protect your agency from costly lawsuits4.

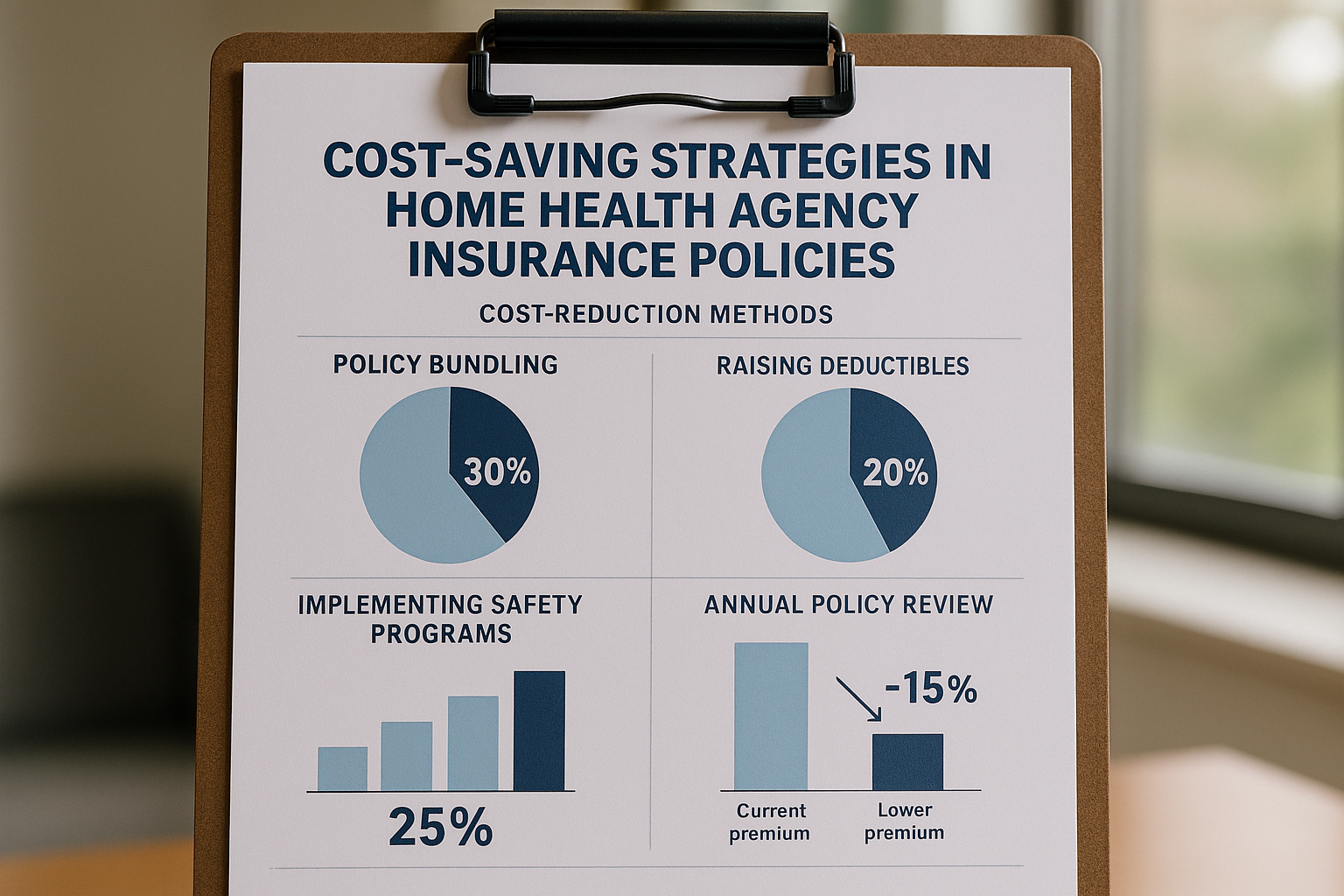

Cost-Saving Strategies and Opportunities

To maximize savings on your insurance policies, consider the following strategies:

- **Bundle Policies**: Many insurers offer discounts when you purchase multiple types of coverage from them. This not only simplifies your insurance management but also reduces costs5.

- **Increase Deductibles**: Opting for higher deductibles can lower your premium costs. This is a viable option if your agency has a stable financial footing and can handle higher out-of-pocket expenses in the event of a claim.

- **Risk Management Programs**: Implementing safety and risk management programs can reduce the likelihood of claims, which in turn can lower your premiums. Many insurers offer reduced rates to agencies that demonstrate proactive risk management6.

Exploring Specialized Solutions

For agencies looking to tailor their insurance further, specialized solutions are available. Some insurers offer bespoke policies that cater specifically to the unique needs of home health agencies, providing additional layers of protection and peace of mind. By visiting websites of reputable insurance providers, you can browse options and find policies that align perfectly with your business needs.

Securing the right insurance policies for your home health agency is not just a regulatory necessity but a strategic move that can save you thousands of dollars. By understanding the types of coverage available and leveraging cost-saving strategies, you can protect your business while optimizing your financial resources. Don't hesitate to follow the options provided by specialized insurers to ensure your agency is comprehensively covered.