Master Strategies Revealed for Hottest SBA Acquisition Financing

Unlock the potential of SBA acquisition financing to expand your business portfolio by exploring strategic options and valuable insights that await you when you browse options and visit websites for more details.

Understanding SBA Acquisition Financing

SBA acquisition financing is a powerful tool for entrepreneurs looking to purchase existing businesses. The Small Business Administration (SBA) offers loan programs that provide favorable terms, lower down payments, and longer repayment periods compared to conventional loans. This makes it an attractive option for those seeking to expand their business holdings without the burden of excessive financial strain.

Types of SBA Loans for Acquisition

The most common SBA loan used for business acquisitions is the SBA 7(a) loan. This versatile loan program allows for a wide range of uses, including purchasing a business, real estate, or equipment. The maximum loan amount is $5 million, and the SBA guarantees up to 85% for loans up to $150,000 and 75% for loans greater than that amount1.

Another option is the SBA 504 loan, which is specifically designed for purchasing fixed assets like real estate and equipment. While not primarily used for business acquisitions, it can be part of a financing package that includes a 7(a) loan for a comprehensive acquisition strategy2.

Key Benefits of SBA Acquisition Financing

One of the main advantages of SBA acquisition financing is the reduced risk for lenders, which translates into more favorable terms for borrowers. These loans typically offer lower interest rates and longer repayment terms, often up to 10 years for business acquisitions and 25 years for real estate purchases3. This can significantly improve cash flow and allow business owners to reinvest in growth opportunities.

Furthermore, SBA loans usually require lower down payments, often as low as 10%, which makes it easier for entrepreneurs to secure the necessary funds without depleting their savings. This accessibility is crucial for small business owners who may not have substantial capital reserves.

Eligibility and Application Process

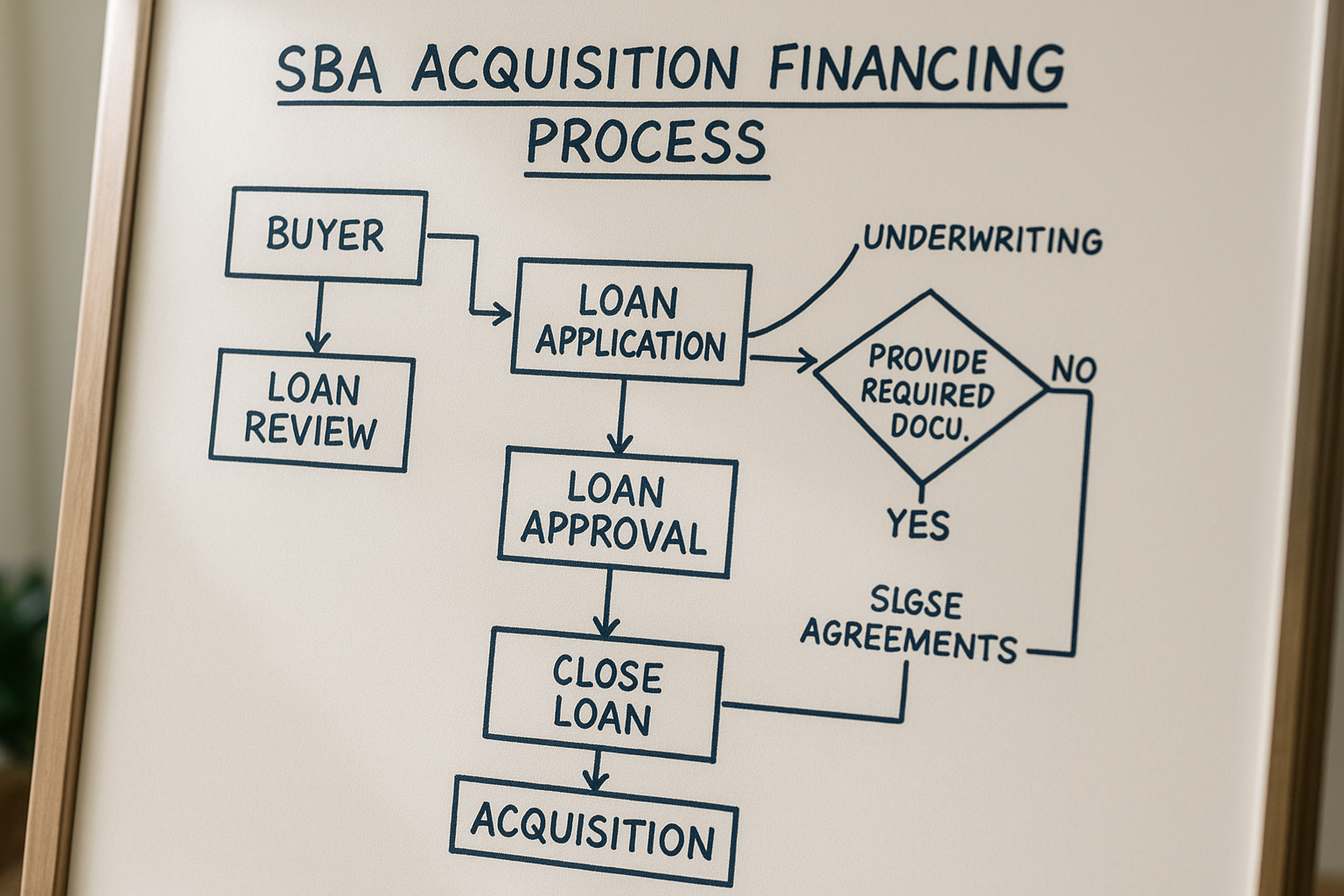

To qualify for an SBA loan, the business must operate for profit, be located in the U.S., and meet the SBA's size standards. Additionally, the borrower must demonstrate good credit, management experience, and the ability to repay the loan. The application process involves submitting a detailed business plan, financial statements, and personal background information4.

It's advisable to work with an SBA-approved lender who can guide you through the application process and help you understand the specific requirements and documentation needed.

Real-World Examples and Success Stories

Many entrepreneurs have successfully used SBA acquisition financing to grow their businesses. For instance, a small manufacturing company in Michigan expanded its operations by acquiring a competitor with the help of an SBA 7(a) loan. This strategic move allowed them to increase their market share and improve operational efficiencies, leading to a 20% increase in revenue within the first year5.

Final Thoughts

SBA acquisition financing offers a wealth of opportunities for entrepreneurs looking to expand their business empires. By understanding the different loan options, benefits, and application processes, you can strategically position yourself for growth. Explore the possibilities by browsing options and visiting websites to learn more about how SBA financing can be the key to your business success.