Prequalify instantly manage property finances effortlessly now

Prequalifying instantly to manage your property finances effortlessly can transform how you handle real estate investments, and by exploring these options, you can discover streamlined solutions that save time and maximize profitability.

Understanding Prequalification in Property Finance

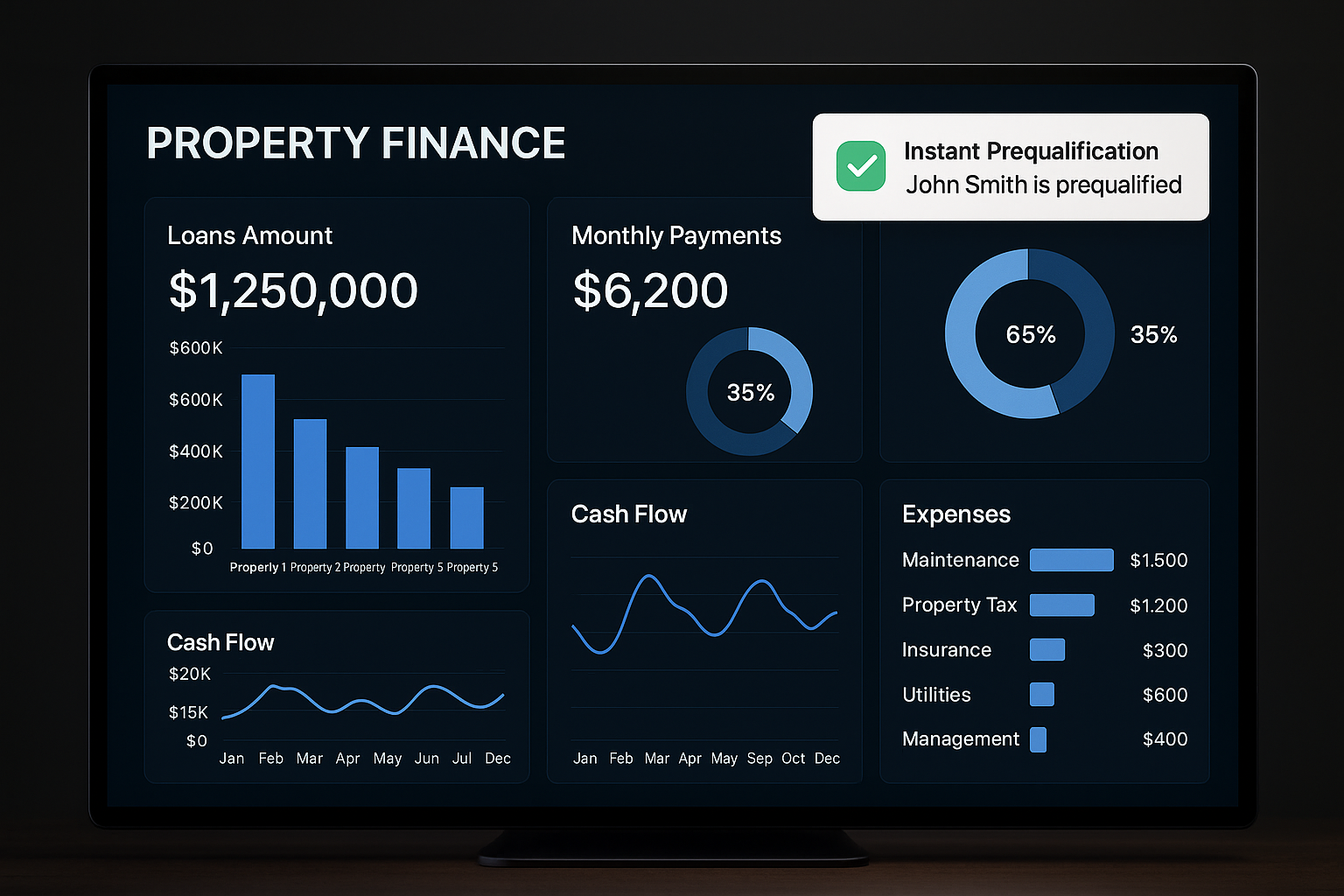

Prequalification is a preliminary step in the property financing process where potential borrowers provide financial information to a lender to estimate how much they can borrow. This step is crucial for property investors and homeowners alike, as it provides a clear picture of purchasing power without impacting credit scores. By prequalifying instantly, you gain a competitive edge in the fast-paced real estate market, allowing you to act swiftly when the right opportunity arises.

The Benefits of Instant Prequalification

Instant prequalification offers numerous advantages. Firstly, it simplifies the financial planning process by giving you a realistic budget. This allows you to narrow your search options and focus on properties within your financial reach. Secondly, it enhances your negotiating power with sellers, as it demonstrates serious intent and financial readiness. Lastly, it can save time by streamlining the mortgage application process, allowing you to secure financing more efficiently1.

Effortlessly Managing Property Finances

Managing property finances can be daunting, but with the right tools and strategies, it becomes significantly more manageable. Utilizing financial management software tailored for real estate can automate many aspects of property management, from tracking income and expenses to generating financial reports. These tools often integrate with bank accounts and provide real-time financial data, enabling you to make informed decisions quickly2.

Real-World Examples and Data

Consider the case of Jane, a property investor who used instant prequalification to expand her portfolio efficiently. By prequalifying, she was able to browse options within her budget and secure financing for a new property within weeks. This swift action resulted in a 15% increase in her rental income over the following year. Such real-world examples illustrate the tangible benefits of leveraging prequalification and financial management tools in the property market3.

Exploring Specialized Services

For those seeking more tailored solutions, numerous specialized services can enhance your property financing and management experience. For instance, some platforms offer personalized financial advice and custom loan options that align with your investment strategy. By visiting websites that provide these services, you can explore a range of options that cater to your specific needs, ensuring you maximize your investment returns4.

The ability to prequalify instantly and manage property finances effortlessly is a game-changer for anyone involved in real estate. By understanding the process, leveraging technology, and exploring specialized services, you can enhance your financial strategy and achieve your property investment goals with confidence. For those ready to take the next step, exploring these options could be the key to unlocking new opportunities in the property market.