Revealed Secrets to Cut Renters Insurance Costs Now

Discover how you can dramatically reduce your renters insurance costs today by exploring a variety of cost-saving strategies and options that could lead to significant savings when you browse options and visit websites.

Understanding Renters Insurance

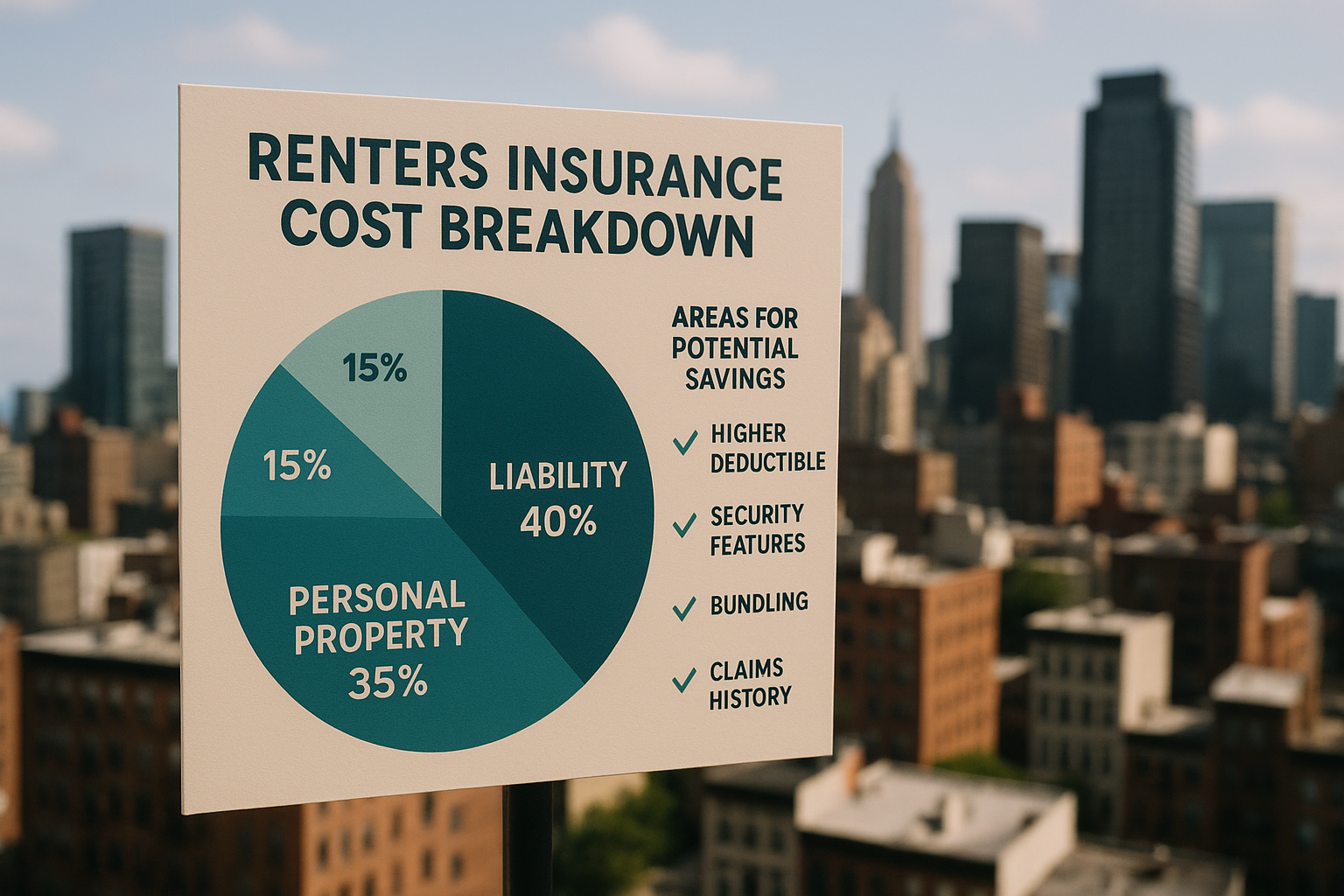

Renters insurance is a crucial yet often overlooked aspect of renting a home. It provides coverage for personal belongings, liability protection, and additional living expenses in case of emergencies. However, many renters find themselves overpaying for coverage they don't fully utilize. By understanding the components of renters insurance, you can effectively cut costs and tailor your policy to fit your needs.

Evaluate Your Coverage Needs

The first step in reducing your renters insurance costs is to evaluate your coverage needs. Many policies include unnecessary add-ons that inflate premiums. Consider the value of your possessions and the risks specific to your location. For instance, if you live in a low-crime area, you might opt for a lower coverage limit on theft. By customizing your policy, you can avoid paying for coverage you don't need.

Increase Your Deductible

One of the simplest ways to lower your premium is to increase your deductible. The deductible is the amount you pay out of pocket before your insurance kicks in. By opting for a higher deductible, you can significantly reduce your monthly or annual premiums. However, ensure that the deductible is an amount you can comfortably afford in case of a claim.

Bundle Policies

Bundling your renters insurance with other policies, such as auto insurance, can lead to substantial discounts. Many insurance companies offer multi-policy discounts, which can reduce your overall premium costs. It's worth exploring different providers to see which offers the best bundling deals. For instance, companies like State Farm and Allstate are known for offering competitive discounts for bundled policies12.

Leverage Discounts

Insurance companies often provide various discounts that can help lower your premiums. These might include discounts for having safety features in your apartment, such as smoke detectors, burglar alarms, or fire extinguishers. Additionally, some insurers offer discounts for long-term policyholders or those with a claim-free history. Be proactive in asking your insurer about available discounts and how you can qualify for them.

Shop Around and Compare

One of the most effective ways to ensure you're getting the best deal on renters insurance is to shop around and compare quotes from multiple providers. Prices can vary significantly between companies for the same coverage levels. Use online comparison tools to easily compare options and find the most competitive rates. Websites like NerdWallet and Policygenius provide valuable resources for comparing renters insurance34.

Maintain a Good Credit Score

Your credit score can impact your insurance premiums. Insurers often use credit-based insurance scores to assess risk, and a higher credit score can lead to lower premiums. To maintain a good credit score, pay your bills on time, reduce outstanding debt, and regularly check your credit report for errors. Improving your credit score can be a long-term strategy for reducing insurance costs.

By taking these actionable steps, you can significantly reduce your renters insurance costs without sacrificing coverage. Whether you're increasing your deductible, bundling policies, or simply shopping around, there are numerous opportunities to save. As you explore these options, you'll find that a little effort can lead to substantial savings in the long run.