Revolutionize Commercial Safety with Parametric Wildfire Insurance Today

Are you ready to safeguard your commercial investments against the unpredictable threat of wildfires? Discover the transformative power of parametric wildfire insurance and browse options to protect your assets today.

Understanding Parametric Wildfire Insurance

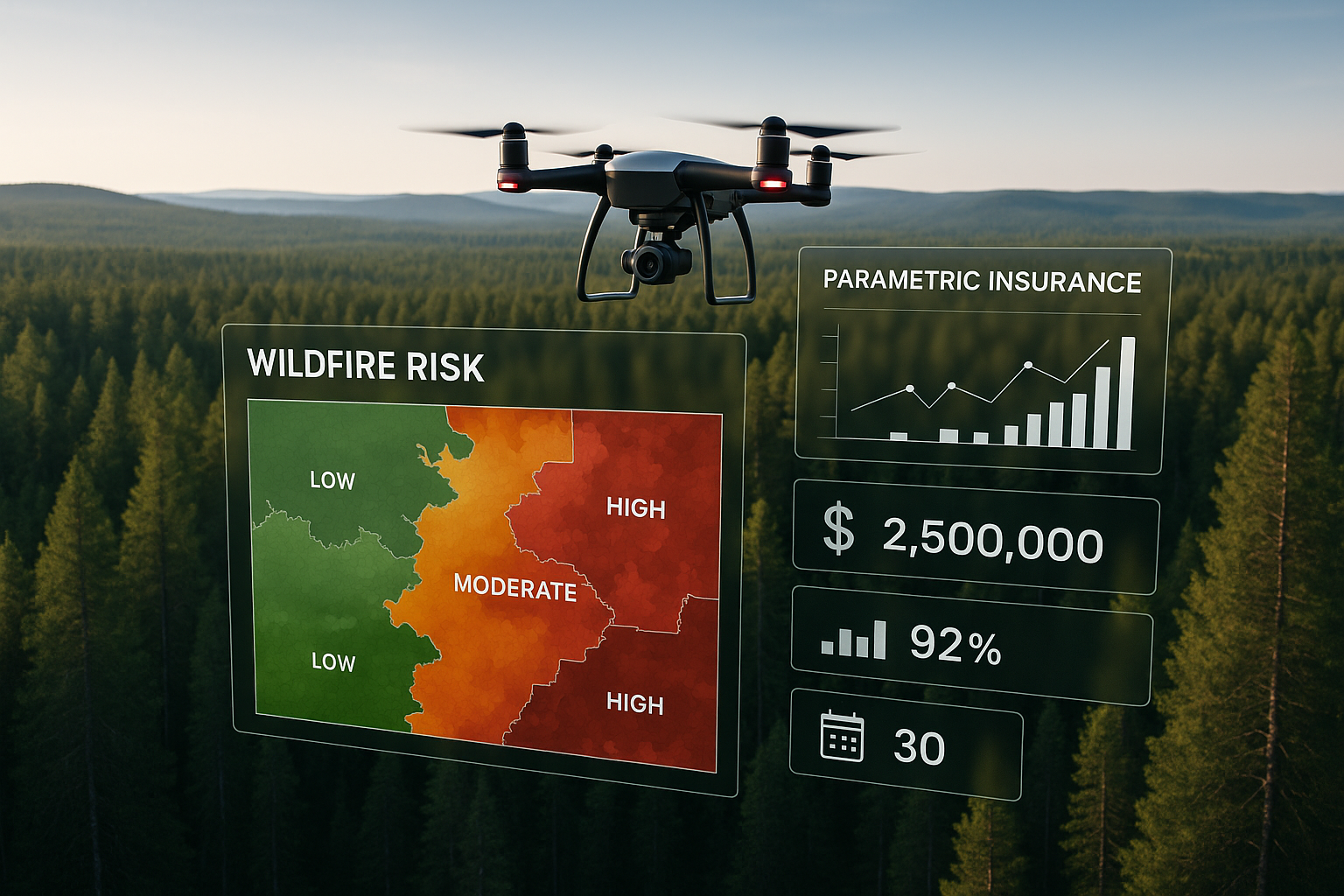

Parametric wildfire insurance represents a groundbreaking approach to managing the financial risks associated with wildfires. Unlike traditional insurance policies that require lengthy claims processes and damage assessments, parametric insurance offers a swift, predetermined payout once specific criteria or "triggers" are met. These triggers are typically based on measurable parameters such as the intensity of a wildfire or its proximity to insured properties1.

How It Works

The primary advantage of parametric insurance lies in its simplicity and speed. Once a trigger event occurs, such as a wildfire reaching a certain intensity level, the insurer automatically disburses the agreed-upon payout to the policyholder. This bypasses the traditional claims process, which can be time-consuming and often fraught with disputes over the extent of damage2.

Benefits of Parametric Wildfire Insurance

1. **Speed and Efficiency**: With parametric insurance, you no longer have to wait weeks or months for claims to be processed. The immediate payout allows businesses to quickly recover and resume operations, minimizing downtime and financial loss.

2. **Predictable Payouts**: Since the payout is predetermined, businesses can plan their recovery strategies more effectively, knowing exactly what financial support they will receive if a trigger event occurs.

3. **Reduced Administrative Burden**: The straightforward nature of parametric insurance reduces the administrative workload for both insurers and policyholders, eliminating the need for detailed damage assessments and negotiations3.

4. **Comprehensive Coverage Options**: Businesses can tailor their parametric insurance policies to cover a range of scenarios, from minor disruptions to catastrophic events, ensuring that they have the right level of protection for their specific needs4.

Real-World Applications and Cost Considerations

Parametric insurance is increasingly being adopted by businesses in wildfire-prone regions as a strategic risk management tool. For instance, companies in California and Australia have leveraged these policies to secure their operations against the devastating impacts of wildfires. The cost of parametric insurance varies based on the specific triggers and coverage limits chosen, but it often proves to be a cost-effective solution compared to traditional insurance, especially when considering the speed and certainty of payouts5.

Exploring Your Options

As businesses become more aware of the benefits of parametric insurance, a growing number of insurers are offering specialized policies tailored to wildfire risks. By visiting websites of leading insurance providers, you can explore a variety of policy options designed to meet your unique needs. Whether you are looking to protect a small business or a large enterprise, there are customized solutions available that can provide peace of mind and financial security in the face of wildfire threats.

Parametric wildfire insurance offers a revolutionary way to protect your commercial assets against the growing threat of wildfires. By providing rapid, reliable payouts based on predetermined triggers, it allows businesses to recover quickly and efficiently. As you consider your risk management strategies, take the time to search options and see these options that can safeguard your investments and ensure business continuity in the event of a wildfire.