Rideshare Driver Insurance Ends Money-Wasting Risks Instantly

As a rideshare driver, protecting yourself from unforeseen costs is crucial, and by exploring rideshare driver insurance options, you can instantly eliminate money-wasting risks—browse options to secure your financial peace of mind today.

Understanding Rideshare Driver Insurance

Rideshare driving has become a popular way to earn extra income, but it comes with unique challenges, particularly when it comes to insurance. Traditional personal auto insurance policies often do not cover incidents that occur while driving for rideshare services like Uber or Lyft. This gap can leave drivers vulnerable to significant financial loss in the event of an accident. Rideshare driver insurance bridges this gap, ensuring you are covered during all phases of your ride-sharing activities.

The Phases of Rideshare Coverage

Rideshare insurance typically covers three distinct phases:

- Offline: When you are not using the rideshare app, your personal auto insurance applies.

- App On, No Passenger: When you have the app on but have not yet accepted a ride, you have limited coverage. Rideshare insurance fills gaps left by the rideshare company's insurance, which may only offer minimal liability coverage.

- App On, Passenger Onboard: During this phase, rideshare companies usually provide more comprehensive coverage, but rideshare insurance can offer additional protection against deductibles and other out-of-pocket expenses.

By understanding these phases and securing appropriate insurance, you can ensure that you are fully protected at all times while driving.

The Financial Benefits of Rideshare Insurance

Investing in rideshare driver insurance can save you from potentially crippling financial liabilities. For instance, without proper coverage, you could be responsible for damages exceeding your personal policy limits or for incidents not covered by the rideshare company's insurance. Additionally, rideshare insurance policies are typically affordable, with some starting as low as $6 per month, depending on your location and coverage needs1. This small investment can save you thousands in the event of an accident.

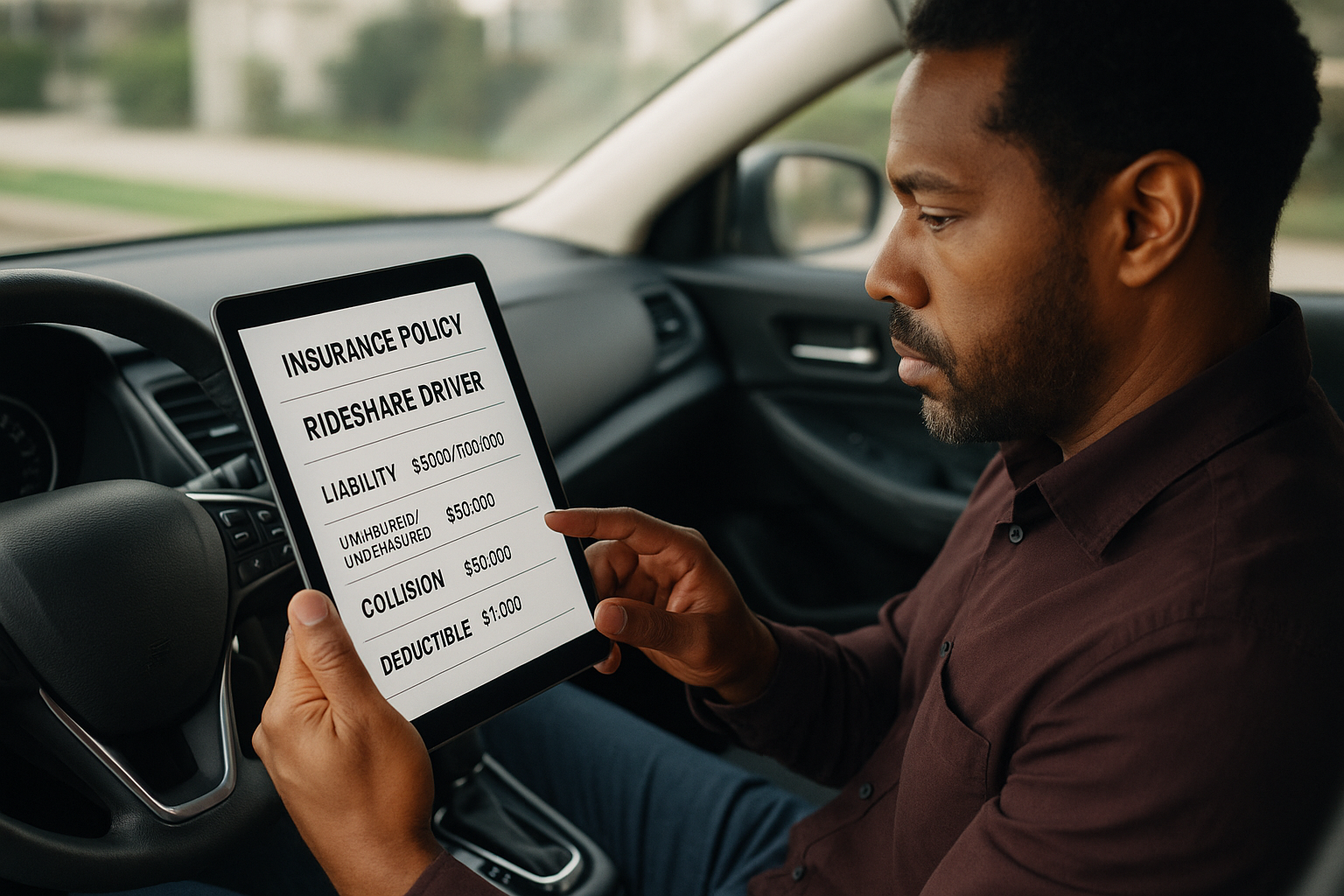

Choosing the Right Policy

When selecting a rideshare insurance policy, consider factors such as the extent of coverage, deductibles, and the reputation of the insurance provider. It's also wise to compare policies from multiple providers to find the best rates and coverage options. Many insurance companies, such as State Farm and Allstate, offer specialized rideshare policies tailored to the needs of drivers2. By taking the time to search options and compare, you can ensure you get the best deal.

Real-World Examples

Consider the case of a driver who was involved in a multi-vehicle accident while en route to pick up a passenger. Without rideshare insurance, this driver would have faced significant out-of-pocket expenses due to the limitations of both their personal insurance and the rideshare company's coverage. However, with a rideshare insurance policy in place, they were able to cover these costs without financial strain3.

Another driver who invested in rideshare insurance found that their policy not only covered collision damages but also provided rental reimbursement, ensuring they could continue working without interruption4.

As a rideshare driver, safeguarding your earnings and peace of mind is essential. By exploring and investing in rideshare driver insurance, you can protect yourself from unforeseen financial burdens and focus on maximizing your income. Take action today by visiting websites of insurance providers to see these options and secure the coverage that best suits your needs.