Save Big Fast Compare Auto Insurance Quotes Online

Unlock significant savings on your auto insurance by taking a moment to browse options and compare quotes online, where you can discover the best deals tailored to your needs and budget.

Understanding the Importance of Comparing Auto Insurance Quotes

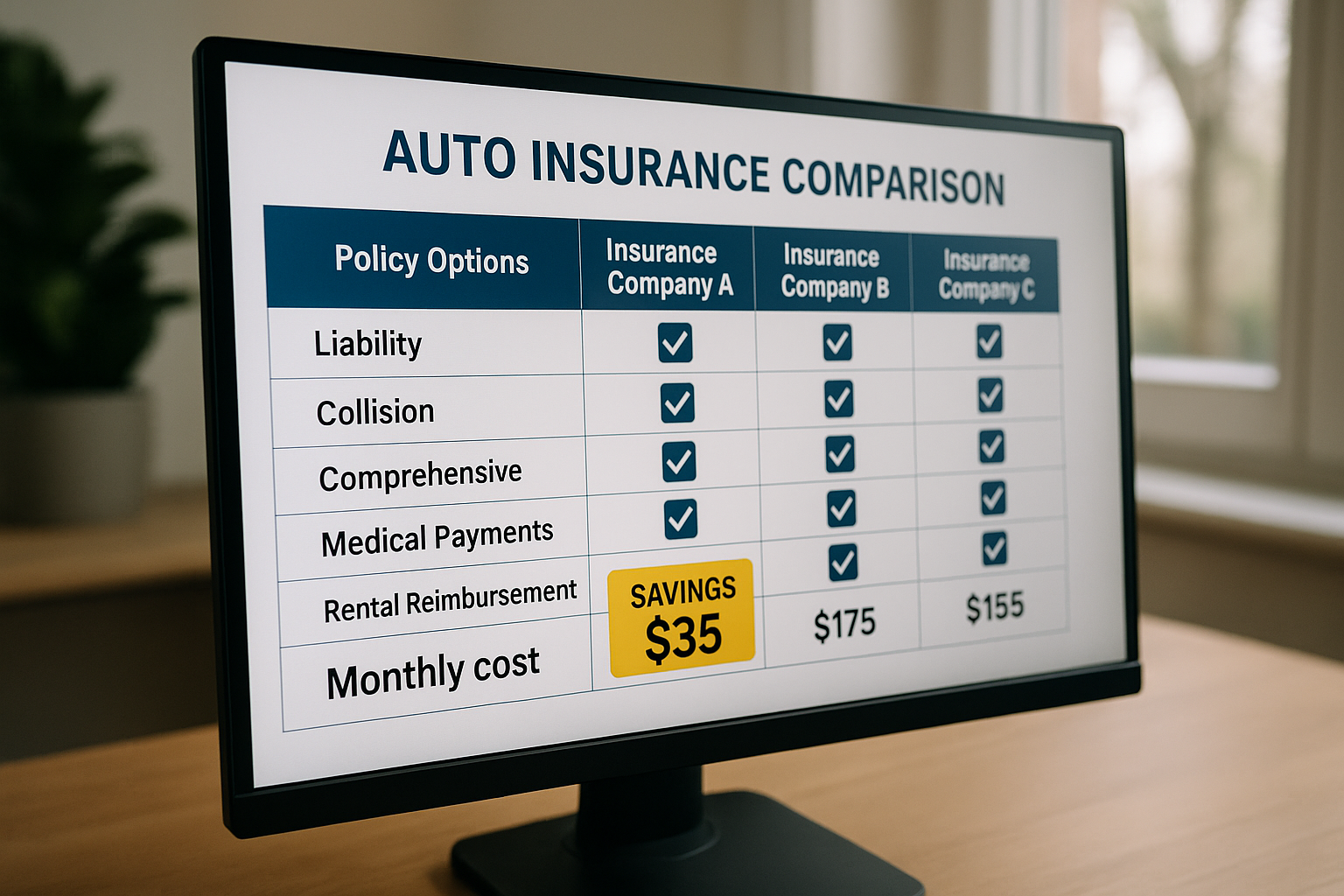

Auto insurance is a necessary expense for car owners, but that doesn't mean you should pay more than you have to. By comparing auto insurance quotes online, you can quickly identify the best coverage options at the most competitive rates. This process not only saves you money but also ensures that you are adequately protected on the road. In fact, many consumers who compare insurance quotes can save up to hundreds of dollars annually1.

How Comparing Quotes Helps You Save

When you compare auto insurance quotes, you are essentially pitting insurers against each other to win your business. This competitive environment often leads to better deals and discounts. Insurers may offer lower premiums, bundle discounts, or even loyalty rewards to attract new customers. For instance, some companies provide discounts for bundling auto and home insurance or for maintaining a clean driving record2.

Steps to Compare Auto Insurance Quotes Online

The process of comparing auto insurance quotes online is straightforward and can be completed in a few simple steps:

- Gather your information: Before you start, have your vehicle details, current insurance policy, and driving history ready.

- Visit insurance comparison websites: Websites like The Zebra, NerdWallet, or Policygenius allow you to input your information and receive multiple quotes from various insurers3.

- Analyze the coverage: Review each quote carefully, focusing on coverage limits, deductibles, and any additional benefits or discounts.

- Contact insurers directly: If you find a quote that interests you, consider reaching out to the insurer for more details or to negotiate better terms.

Factors That Influence Auto Insurance Rates

Several factors can affect your auto insurance rates, including your age, driving history, vehicle type, and location. For example, younger drivers or those with a history of traffic violations may face higher premiums. Additionally, living in an area with high traffic or crime rates can also increase your insurance costs4.

Additional Resources for Specialized Needs

For those with specific insurance needs, such as high-risk drivers or classic car owners, specialized insurance providers offer tailored solutions. These providers can offer policies that cater to unique circumstances, ensuring you receive adequate protection without overpaying. Exploring these specialized options can be beneficial for securing the best possible coverage.

Taking the time to compare auto insurance quotes online is a savvy financial move that can lead to significant savings and better coverage. By understanding the factors that influence insurance rates and exploring various options, you can make an informed decision that suits your personal and financial needs. Don't miss out on the opportunity to explore these options and secure the best deal for your auto insurance today.