Save Thousands with Builders Risk Insurance Data Insight

Unlock significant savings on your construction projects by exploring Builders Risk Insurance options that could protect your bottom line and provide peace of mind—browse options now to secure the best deals for your needs.

Understanding Builders Risk Insurance

Builders Risk Insurance, also known as Course of Construction Insurance, is a specialized type of property insurance designed to protect buildings under construction. This insurance covers various risks, including theft, vandalism, and certain types of weather damage, ensuring that your investment is safeguarded from unforeseen events. By securing this insurance, you can mitigate potential financial losses that could otherwise derail your project.

The Financial Benefits of Builders Risk Insurance

One of the most compelling reasons to invest in Builders Risk Insurance is the potential to save thousands of dollars. Construction projects are inherently risky, with numerous variables that can lead to costly setbacks. For instance, if a severe storm damages your partially constructed building, the repair costs could be substantial. Builders Risk Insurance covers these types of losses, allowing you to avoid out-of-pocket expenses that could significantly impact your budget.

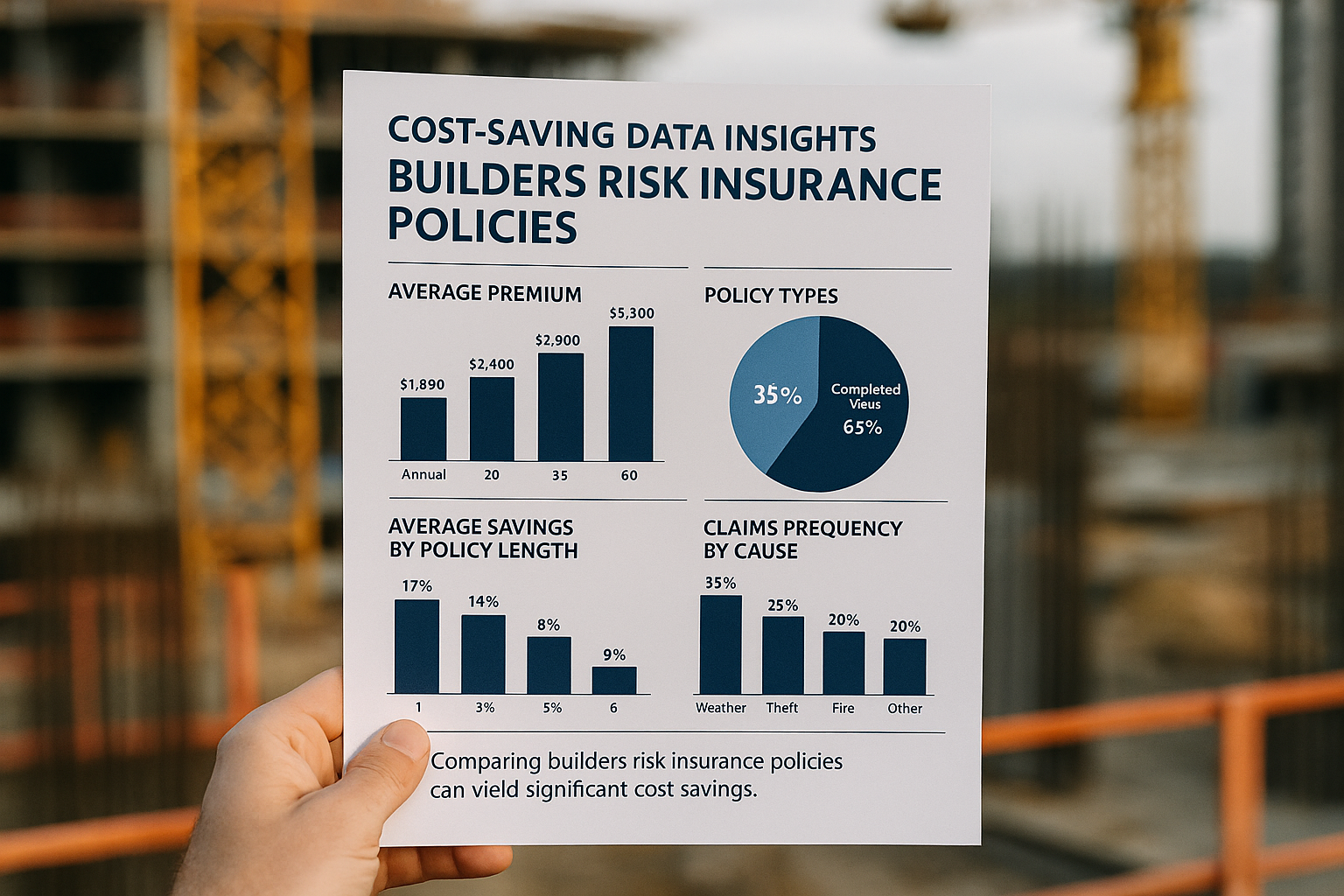

Moreover, many insurance providers offer competitive rates and discounts that can further reduce your premiums. By shopping around and comparing different policies, you can find an option that fits your budget while providing comprehensive coverage. It's advisable to visit websites of various insurers to see these options and find the best deals available.

Key Coverage Areas

Builders Risk Insurance typically covers a range of potential issues that could arise during construction:

- Property Damage: This includes damage to the structure itself and materials on-site that are essential for the project.

- Theft and Vandalism: Construction sites are common targets for theft and vandalism, and this insurance can cover the replacement costs of stolen or damaged items.

- Weather Events: While not all-natural disasters are covered, many policies include protection against common weather-related damages such as wind and hail.

- Fire: Fires can cause extensive damage to construction sites, and having insurance ensures you're protected against such losses.

Choosing the Right Policy

Selecting the right Builders Risk Insurance policy involves understanding the specific needs of your project and the risks it faces. Factors to consider include the location of your site, the type of construction, and the duration of the project. Policies can be tailored to cover the entire construction period, from the beginning of the project until its completion.

It's also important to consider the exclusions in your policy. Some common exclusions include wear and tear, employee theft, and specific natural disasters like earthquakes or floods, unless additional coverage is purchased. Therefore, it’s crucial to thoroughly review policy details and consult with an insurance expert to ensure comprehensive coverage.

Real-World Examples and Savings

Consider a scenario where a construction company without Builders Risk Insurance faces a $50,000 loss due to theft of materials. This unexpected expense could delay the project and strain financial resources. On the other hand, a company with Builders Risk Insurance would have these costs covered, allowing the project to continue without financial disruption.

Additionally, many insurers provide discounts for bundling policies or implementing safety measures on-site, such as security systems and surveillance cameras. These savings can accumulate over time, significantly reducing the overall cost of insurance.

Exploring Your Options

To maximize your savings and ensure the best protection for your construction projects, it's essential to explore various Builders Risk Insurance options. Start by searching for reputable insurers and comparing their offerings. Many companies provide online tools to calculate potential premiums, giving you a clearer picture of the costs involved.

By following the options available and visiting websites of top insurers, you can find tailored solutions that meet your specific needs and budget constraints. The right policy not only protects your investment but also provides peace of mind, knowing that you're prepared for any eventuality.

References

By understanding the nuances of Builders Risk Insurance and actively seeking out the best options, you can protect your construction projects from unforeseen events and ensure financial stability throughout the building process.