Secret Method Reveals Real Estate Investment Without Big Money

Unlocking the potential of real estate investment without needing big money is not only possible, but it can also open doors to lucrative opportunities—browse options and explore innovative strategies that can transform your financial future today.

Understanding Real Estate Investment Without Large Capital

Real estate investment has traditionally been associated with substantial capital requirements, often deterring those with limited funds from entering the market. However, innovative methods and strategies have emerged, allowing individuals to invest in real estate without hefty upfront costs. These methods not only democratize real estate investing but also offer potential for significant returns.

Real Estate Crowdfunding

One of the most accessible ways to invest in real estate with limited funds is through real estate crowdfunding platforms. These platforms pool money from multiple investors to fund real estate projects, allowing you to invest with as little as $500 or less. This approach provides an opportunity to diversify your investment across different properties and markets, reducing risk while maximizing potential returns. According to a report by the National Association of Realtors, crowdfunding has been gaining traction due to its ability to democratize access to real estate investments1.

Real Estate Investment Trusts (REITs)

Another viable option is investing in Real Estate Investment Trusts (REITs). REITs are companies that own, operate, or finance income-generating real estate across a range of property sectors. By purchasing shares in a REIT, you can earn a portion of the income produced through real estate investment without having to buy, manage, or finance any properties yourself. The U.S. Securities and Exchange Commission highlights that REITs offer a way to invest in real estate while maintaining liquidity similar to stocks2.

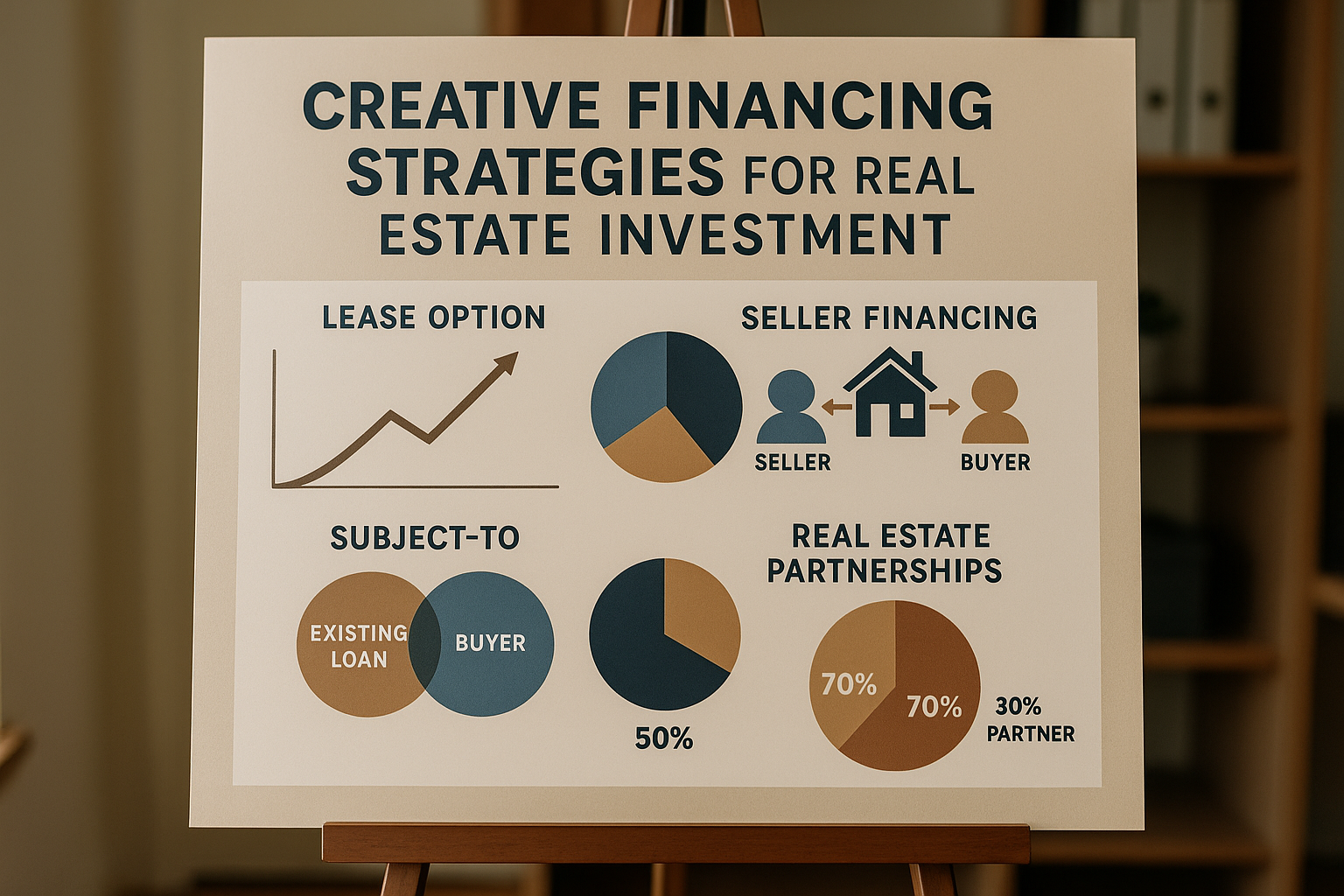

Lease Options

Lease options, also known as rent-to-own agreements, provide another method for investing in real estate without significant capital. This strategy involves leasing a property with the option to purchase it before the lease expires. It allows you to control a property and benefit from its appreciation in value while deferring the purchase. This can be particularly advantageous in markets with rising property values, where you can lock in a purchase price at the beginning of the lease term.

House Hacking

House hacking is a creative strategy that involves purchasing a multi-unit property, living in one unit, and renting out the others. This approach can significantly reduce your living expenses and help you build equity in the property over time. By leveraging rental income to cover mortgage payments, you can effectively live for free or even generate positive cash flow. The concept of house hacking has been popularized by numerous real estate investors as a low-risk entry point into property ownership3.

Partnering with Investors

Forming partnerships with other investors can also facilitate real estate investment without large amounts of personal capital. By pooling resources, you can jointly purchase properties and share the responsibilities and profits. This collaborative approach not only reduces individual financial burdens but also allows you to leverage the expertise and networks of your partners.

Exploring these innovative real estate investment strategies can unlock new pathways to financial growth without the need for substantial initial capital. Whether you choose to dive into crowdfunding, invest in REITs, or explore house hacking, these options provide a gateway to the lucrative world of real estate. As you browse options and search for the best fit for your financial goals, remember that real estate investment can be both accessible and rewarding.