Secrets Behind Crazy Low Truck Refinance Rates Unveiled

Unlocking the secrets behind crazy low truck refinance rates can empower you to save significantly on your monthly payments while optimizing your business cash flow, so why not browse options and see these opportunities for yourself?

Understanding Truck Refinance Rates

Refinancing your truck loan can be a strategic move to reduce your financial burden and improve your bottom line. The allure of low refinance rates is particularly appealing for businesses and individual truck owners looking to cut costs. But what exactly drives these rates down, and how can you take advantage of them?

Factors Influencing Low Refinance Rates

Truck refinance rates are influenced by a variety of factors, including market conditions, your credit score, and the overall loan amount. During periods of economic stability, lenders are often more willing to offer competitive rates to attract borrowers. Additionally, a strong credit score can position you as a low-risk borrower, enabling you to negotiate better terms. For those with less-than-perfect credit, there are still options available, as some lenders specialize in working with a wider range of credit profiles.

Benefits of Refinancing Your Truck Loan

Refinancing your truck loan can offer multiple benefits. First and foremost, it can lead to lower monthly payments, freeing up cash for other business expenses. Additionally, you may secure a lower interest rate, which can reduce the total cost of the loan over its lifetime. This can be especially beneficial if your credit score has improved since you first took out the loan. Furthermore, refinancing can enable you to change the loan term, either shortening it to pay off the loan faster or extending it to reduce monthly payments.

Steps to Take When Considering Refinancing

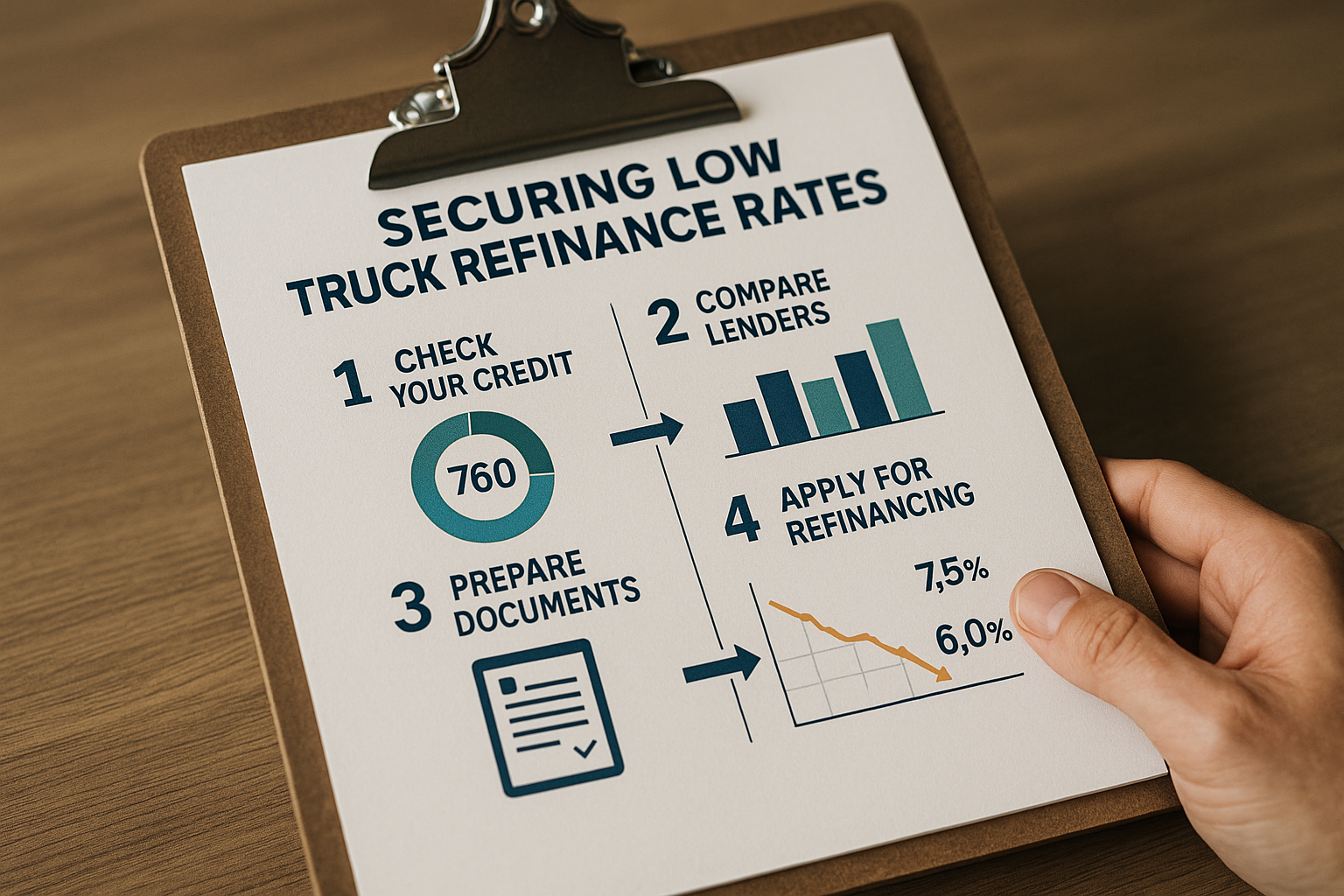

To maximize the benefits of refinancing, it's essential to follow a strategic approach:

- Assess Your Current Loan: Understand the terms of your existing loan, including the interest rate, remaining balance, and payment schedule. This will help you determine if refinancing is the right choice.

- Check Your Credit Score: Your credit score plays a crucial role in the rates you can secure. Ensure your credit report is accurate and consider taking steps to improve your score if necessary.

- Shop Around: Different lenders offer varying rates and terms, so it's important to compare options. Use online tools to browse options and find the best deal for your situation.

- Calculate Potential Savings: Use a refinance calculator to estimate your potential savings. This will help you weigh the benefits against any costs associated with refinancing.

Real-World Examples and Success Stories

Many truck owners have successfully reduced their financial obligations through refinancing. For instance, a small logistics company in Texas managed to lower their monthly payments by 15% by refinancing their fleet of trucks, allowing them to reinvest the savings into expanding their operations1. Similarly, an independent owner-operator in California improved his cash flow significantly by securing a lower interest rate, which helped him weather economic fluctuations2.

Exploring Specialized Services

For those seeking tailored solutions, specialized financing services can offer customized refinance options. These services often have access to a broader range of lenders and can provide guidance on selecting the best terms for your unique situation. Visiting websites that specialize in truck loans can provide additional resources and insights to help you make an informed decision.

By understanding the dynamics of truck refinance rates and taking a strategic approach, you can unlock significant financial benefits and strengthen your business's financial position. Don't hesitate to explore these opportunities and browse options to find the best rates available, ensuring you make the most of your investment.