Secure Big Savings Workers Comp Insurance Secrets Revealed

Unlocking the secrets to secure big savings on workers' compensation insurance can significantly impact your business's bottom line, and by taking a moment to browse options and explore specialized services, you can discover valuable strategies to reduce costs effectively.

Understanding Workers' Compensation Insurance

Workers' compensation insurance is a crucial component for businesses, providing financial protection against workplace injuries and illnesses. It covers medical expenses and lost wages for employees who get injured on the job, ensuring both the employee's and employer's security. However, the cost of this insurance can be a significant burden for many businesses, especially small to medium-sized enterprises.

Strategies to Reduce Workers' Compensation Costs

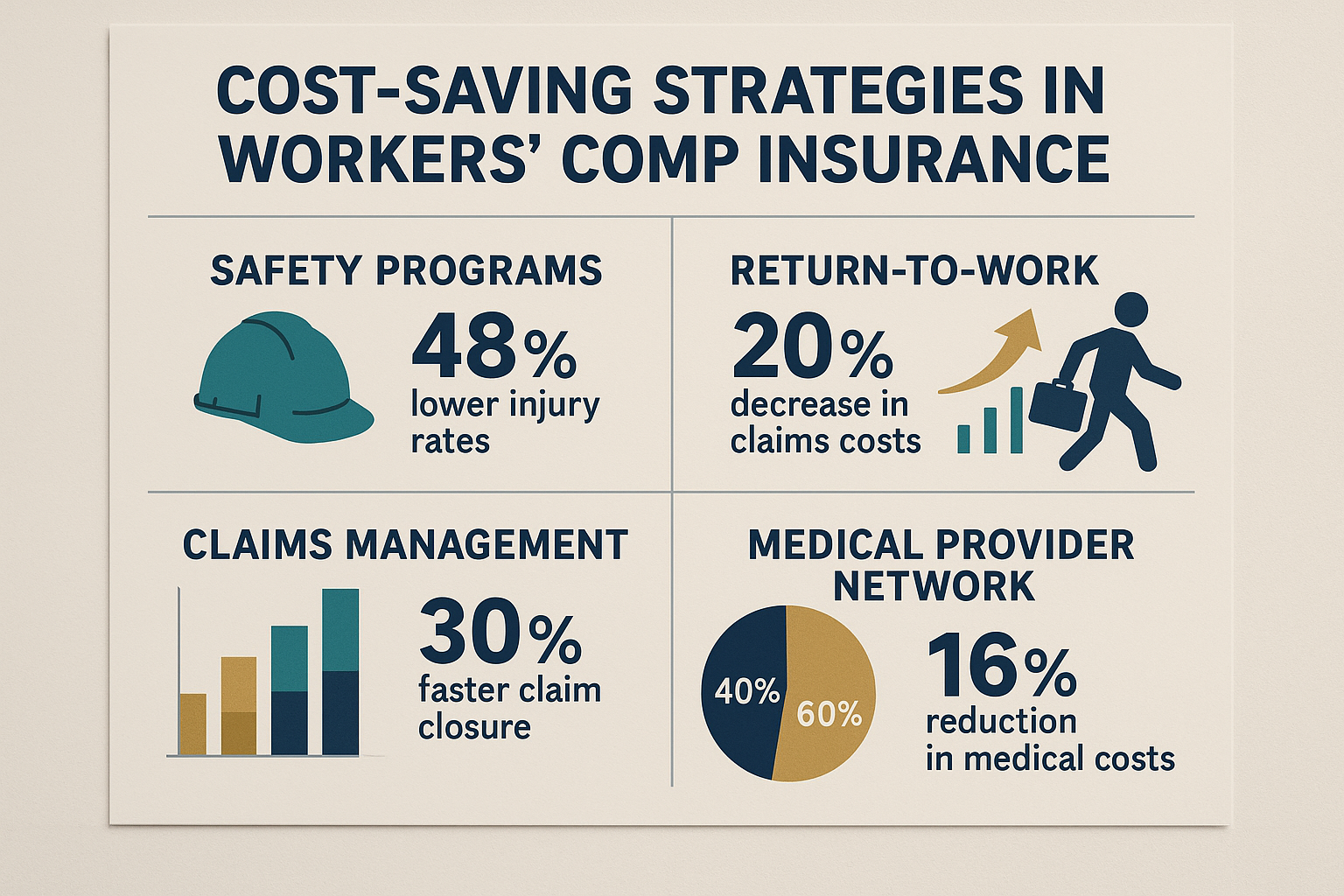

One of the most effective ways to reduce your workers' compensation insurance costs is by implementing a comprehensive safety program. A safer workplace not only reduces the likelihood of accidents but also lowers your insurance premiums over time. According to the Occupational Safety and Health Administration (OSHA), businesses can save $4 to $6 for every $1 invested in safety programs1.

Another strategy is to regularly review and update your insurance policy. By comparing different policies, you can ensure that you are not overpaying for coverage. Many insurance providers offer discounts for bundling services or for businesses with a proven track record of safety. Be sure to search options and consult with insurance brokers who might have access to exclusive deals.

Understanding Experience Modification Rate (EMR)

The Experience Modification Rate (EMR) plays a significant role in determining your workers' compensation insurance premiums. An EMR below 1.0 indicates better-than-average claims experience, which can lead to lower premiums. Conversely, an EMR above 1.0 indicates higher claims experience and can increase your costs. By implementing effective risk management practices, you can improve your EMR and, subsequently, reduce your insurance premiums2.

Leveraging Return-to-Work Programs

Return-to-work programs are another effective way to manage workers' compensation costs. These programs help injured employees return to work in a modified or alternative capacity while they recover. This approach not only reduces the duration of claims but also helps maintain employee morale and productivity. Studies have shown that businesses with return-to-work programs can see a reduction in their workers' compensation costs by up to 25%3.

Exploring Additional Resources

For businesses seeking more specialized solutions, there are various resources available. Websites and services dedicated to risk management can provide insights into industry-specific safety practices and insurance options. By visiting these websites, you can gain access to tools and services that tailor solutions to your business's unique needs, ultimately leading to more efficient cost management.

Incorporating these strategies can lead to significant savings on workers' compensation insurance, allowing you to allocate resources more effectively and invest in other areas of your business. Remember, the key to unlocking these savings lies in proactive management and continuous exploration of the available options tailored to your business's needs.