Secure Multi-State Coverage Simplifying Medical Practice Risks

As a medical practitioner aiming to mitigate risks while expanding your practice across multiple states, securing comprehensive multi-state coverage can be your game-changer, and by browsing the options available, you can find the perfect fit for your needs.

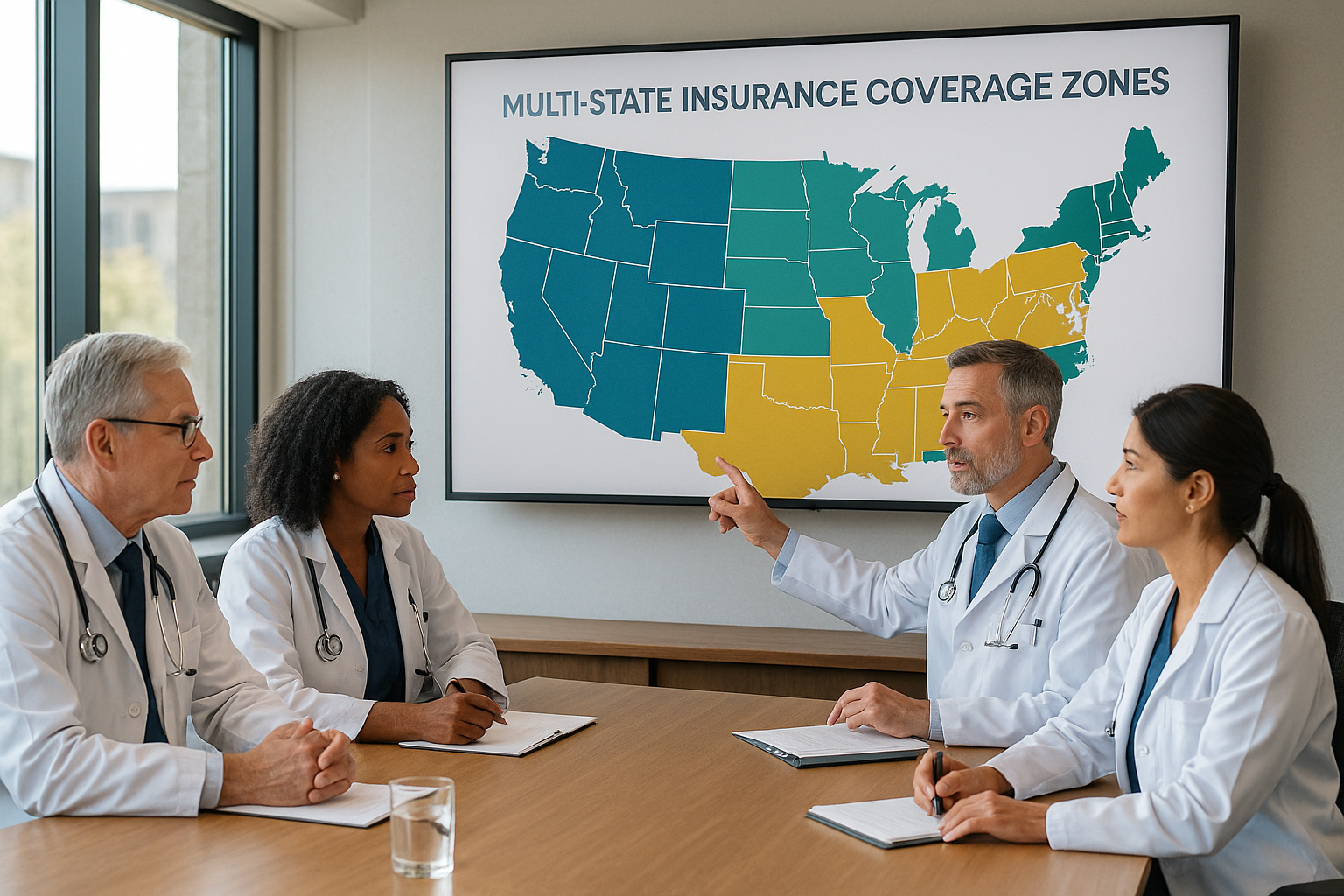

Understanding Multi-State Coverage

Multi-state coverage is essential for medical practices that operate in more than one state, as it provides a unified insurance solution that addresses the varying legal and regulatory requirements across state lines. This type of coverage simplifies the complexities of managing different policies for each state, ensuring that your practice remains compliant and protected against potential risks. By consolidating your insurance needs, you not only save time but also reduce administrative burdens, allowing you to focus more on patient care.

Benefits of Multi-State Coverage

One of the primary benefits of multi-state coverage is the streamlined risk management it offers. Instead of juggling multiple insurance policies, you have a single point of contact that understands the nuances of each state's regulations. This can lead to significant cost savings, as insurers may offer discounts for bundled coverage. Additionally, the comprehensive nature of this coverage means that you are protected against a wide range of risks, from malpractice claims to property damage, ensuring peace of mind as you expand your practice.

Financial Considerations

While the initial cost of multi-state coverage might seem higher than individual state policies, the long-term financial benefits often outweigh the upfront expenses. By negotiating a multi-state policy, you may be eligible for volume discounts that lower your overall premium. Furthermore, the reduction in administrative tasks associated with managing multiple policies can translate into significant savings on operational costs. It's important to conduct a thorough cost-benefit analysis and consult with insurance specialists to determine the most cost-effective strategy for your practice.

Real-World Examples

Consider a healthcare group that operates clinics in California, Nevada, and Arizona. By opting for multi-state coverage, they were able to consolidate their insurance policies, leading to a 15% reduction in their annual insurance costs1. This not only improved their bottom line but also enhanced their ability to provide consistent care across all locations. Another example involves a telemedicine provider who, by securing multi-state coverage, ensured compliance with varying telehealth regulations, thus protecting against potential legal challenges2.

Exploring Your Options

When considering multi-state coverage, it's crucial to evaluate different providers and their offerings. Look for insurers with a strong track record in the healthcare sector and those who offer tailored solutions that meet your specific needs. Many providers offer online tools to help you compare policies and pricing, making it easier to browse options that align with your practice's goals. Additionally, consulting with an insurance broker who specializes in healthcare can provide valuable insights and help you navigate the complexities of multi-state coverage.

Securing multi-state coverage is a strategic move for medical practices looking to expand and manage risks effectively. By exploring the options available, you can find a solution that not only protects your practice but also supports its growth. Take the time to research and engage with specialized services to ensure you choose the best coverage for your needs, and enjoy the peace of mind that comes with comprehensive protection.