Slash Home Insurance with These Vacant Policy Quotes

Are you ready to slash your home insurance costs by exploring vacant policy quotes and uncovering valuable savings opportunities that await when you browse options and visit websites tailored to your needs?

Understanding Vacant Home Insurance

Vacant home insurance is a specialized type of coverage designed for properties that are unoccupied for an extended period, typically more than 30 days. Unlike standard homeowner's insurance, which may not cover certain risks if a home is left vacant, these policies provide protection against perils such as vandalism, theft, and weather-related damage. As a homeowner, you may need this coverage if you're selling your home, renovating, or if the property is a second home that remains unoccupied for long stretches.

Why Vacant Home Insurance is Crucial

When a home is left vacant, it becomes more susceptible to risks. For instance, vacant properties are more likely to be targeted by vandals or burglars. Additionally, maintenance issues such as leaks or electrical problems might go unnoticed, leading to significant damage. Standard homeowner's policies often include clauses that void coverage if a home is unoccupied for a specific period, making vacant home insurance a crucial consideration for safeguarding your investment.

Cost Considerations and Savings Opportunities

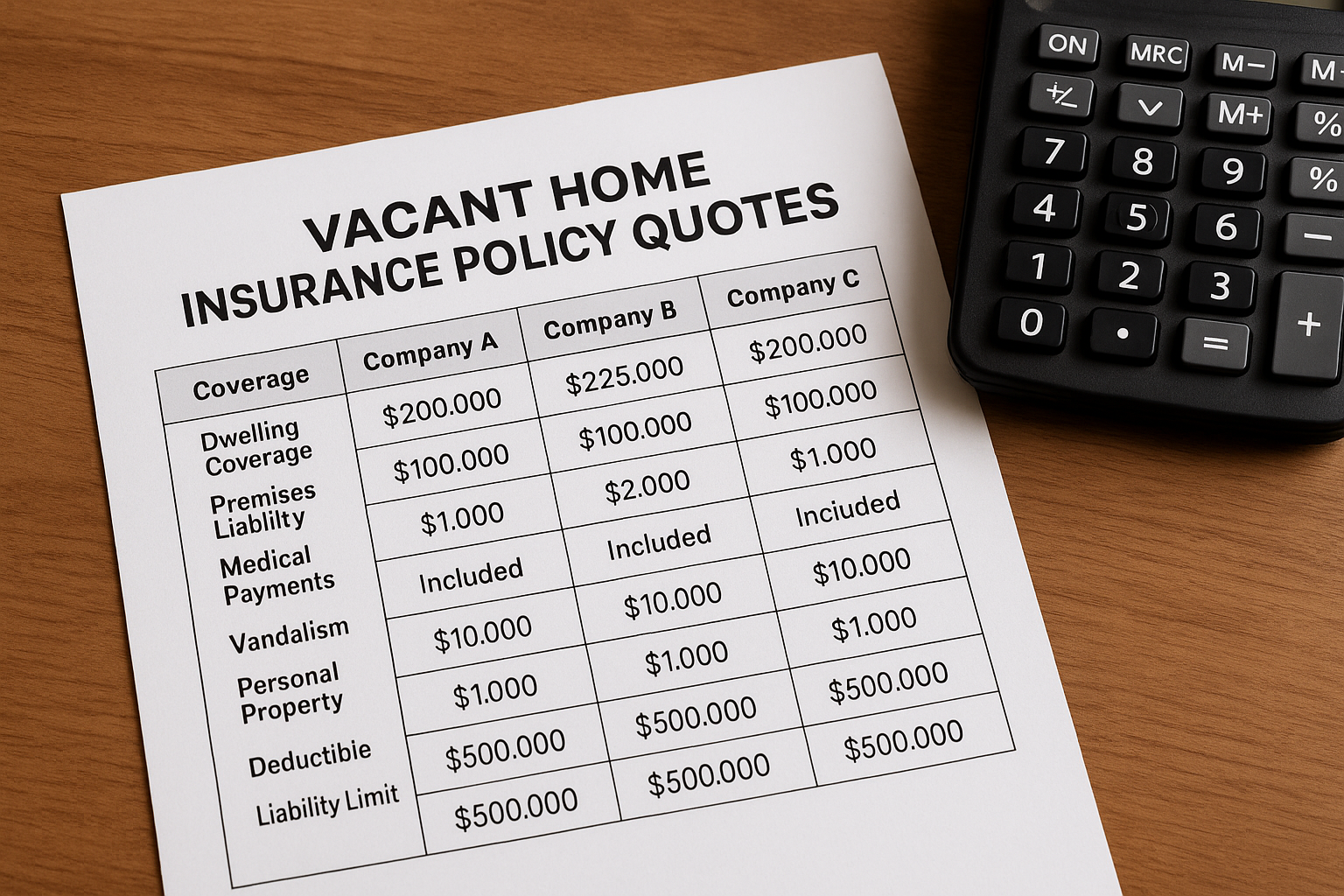

The cost of vacant home insurance can vary depending on several factors, including the property's location, the duration of vacancy, and the level of coverage required. On average, these policies can range from $500 to $1,500 annually1. However, many insurers offer discounts for implementing security measures such as alarm systems or hiring a property manager to conduct regular inspections. By searching for competitive quotes and comparing different providers, you can find policies that fit your budget while offering comprehensive protection.

How to Choose the Right Policy

To select the best vacant home insurance policy, start by assessing your specific needs. Consider the length of time your property will be vacant and any unique risks it might face. It's also essential to evaluate the coverage options available, such as liability coverage, which protects against injuries that might occur on the property. Additionally, some insurers offer flexible policies that can be adjusted as your situation changes, providing peace of mind and financial protection.

Where to Find Vacant Home Insurance Quotes

Finding the right insurance policy requires thorough research and comparison. Start by visiting websites of reputable insurance providers that specialize in vacant home policies. Many insurers allow you to request quotes online, making it easy to compare options without committing. Consider consulting with an insurance broker, who can provide expert advice and help navigate the complexities of coverage options. By taking these steps, you can ensure that your property is adequately protected while potentially saving money.

In summary, vacant home insurance is an essential safeguard for properties that remain unoccupied for extended periods. By understanding the risks and exploring various options, you can find a policy that offers the necessary protection at a competitive price. As you browse options and search for the best deals, remember that investing in the right coverage can provide peace of mind and protect your valuable asset from unforeseen events.