Slash Your Premiums Military Families Exclusive Discounts Await

If you're a military family looking to cut costs on your insurance premiums, now is the perfect time to explore exclusive discounts and browse options that can significantly reduce your financial burden.

Understanding the Benefits of Military Family Discounts

Military families often face unique financial challenges, from frequent relocations to the complexities of deployment. Recognizing these challenges, many insurance companies offer exclusive discounts to military personnel and their families. These discounts can lead to substantial savings on various types of insurance, including auto, home, and life insurance.

Military families can benefit from reduced premiums, which can free up funds for other essential expenses. These discounts are often a token of appreciation for the service and sacrifices made by military personnel. By taking advantage of these offers, families can enjoy peace of mind knowing they are financially protected without breaking the bank.

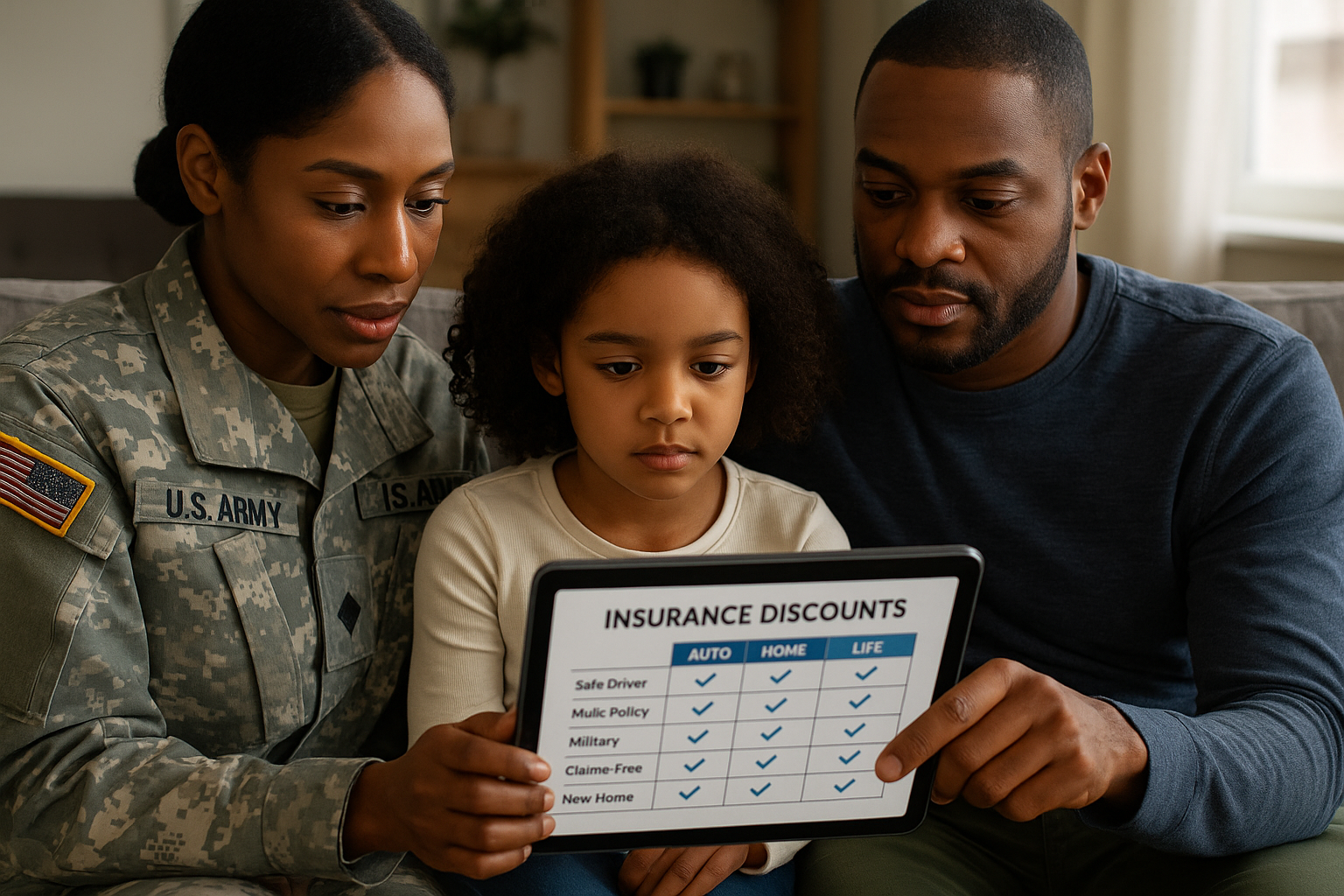

Types of Discounts Available

Several types of discounts are available to military families, and they can vary by provider. Here are some common ones:

- Auto Insurance Discounts: Many insurers offer reduced rates for military personnel, especially if they are deployed overseas or have a clean driving record. Companies like USAA and GEICO are known for providing competitive rates for military members1.

- Home Insurance Discounts: Military families can also enjoy savings on home insurance. These discounts may include lower premiums for homes on military bases or additional coverage options tailored to the needs of military families2.

- Life Insurance Discounts: Specialized life insurance policies are available to military families, offering lower rates and additional benefits such as coverage during active duty3.

How to Access These Discounts

To access these exclusive discounts, military families should start by contacting their current insurance providers to inquire about available offers. It's also beneficial to compare rates from different companies to ensure you're getting the best deal. Many insurers have dedicated military support teams that can assist in tailoring policies to fit your specific needs.

Additionally, military families can leverage resources such as the Department of Veterans Affairs and military-focused financial advisors to explore further savings opportunities. These organizations often have partnerships with insurers, offering additional discounts or benefits.

Real-World Savings Examples

To illustrate the potential savings, consider a family stationed in Virginia who switched to a military-friendly auto insurance provider. They reported saving approximately 15% on their annual premiums, translating to hundreds of dollars each year4.

Another example includes a military family in Texas who utilized a home insurance discount program, saving 10% on their premiums while gaining additional coverage for natural disasters, a crucial consideration in their region.

Taking the Next Steps

Military families seeking to slash their insurance premiums should take proactive steps by researching and comparing options. By visiting websites of insurance providers that offer military discounts and exploring specialized services, families can uncover significant savings. It's essential to stay informed about new offers and regularly reassess insurance needs to ensure continued financial efficiency.

In summary, military families have a wealth of opportunities to reduce insurance costs through exclusive discounts. By leveraging these offers, families can enjoy enhanced financial security and peace of mind. Explore the options available to you today and see how much you can save.