Turn Rent Payments Into Instant Equity With Ease

Imagine transforming your monthly rent payments into a pathway for building equity—an opportunity that can redefine your financial future when you visit websites and browse options designed to make this dream a reality.

Understanding Rent-to-Own Agreements

Rent-to-own agreements offer a unique opportunity for renters to gradually purchase the property they are living in. This model allows you to start building equity while still paying rent. In a rent-to-own contract, a portion of your monthly rent is set aside and contributes towards the eventual purchase of the home. This approach can be particularly beneficial if you're currently unable to secure a mortgage due to credit challenges or insufficient savings for a down payment.

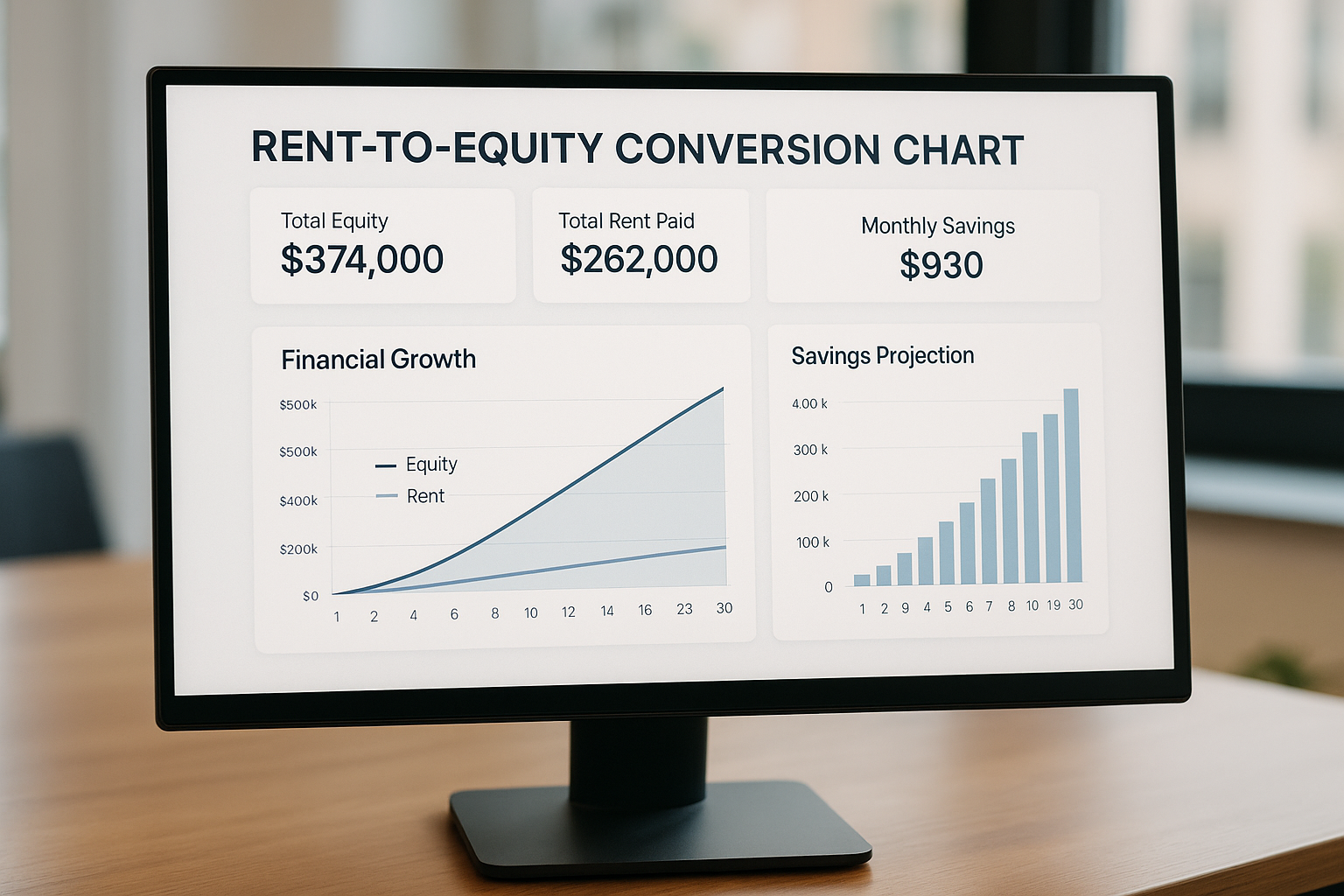

The Financial Benefits of Rent-to-Own

A significant advantage of rent-to-own is the ability to lock in a purchase price at the start of the agreement. This can be particularly advantageous in a rising real estate market, where property values are increasing. By securing a price now, you can potentially save thousands compared to buying the same property outright in the future. Furthermore, the rent credits applied towards the purchase price can reduce the amount you need to finance, making it easier to secure a mortgage when the time comes.

How to Navigate Rent-to-Own Contracts

Rent-to-own contracts can vary significantly, so it's crucial to understand the terms and conditions before signing. Key elements to look out for include the purchase price, the rent credit amount, and the option fee, which is a non-refundable upfront payment that grants you the right to purchase the home in the future. It's advisable to consult with a real estate attorney to ensure the contract is fair and aligns with your financial goals.

Real-World Examples and Success Stories

Consider the case of a young couple in Austin, Texas, who successfully transitioned from renters to homeowners through a rent-to-own agreement. By committing to a three-year contract, they were able to improve their credit score and save for a down payment, all while securing a home in a desirable neighborhood1. Their story is a testament to how strategic planning and understanding the nuances of rent-to-own agreements can lead to successful homeownership.

Exploring Your Options

If you're considering a rent-to-own agreement, it's essential to research and compare different properties and contracts. Many real estate websites offer listings specifically for rent-to-own homes, allowing you to browse options that fit your needs and budget. Additionally, some specialized companies provide services to help match renters with suitable rent-to-own opportunities, making the process more accessible and streamlined2.

Potential Challenges and Considerations

While rent-to-own can be an excellent pathway to homeownership, it's not without its challenges. The primary risk is the possibility of not being able to purchase the home at the end of the lease term, which would result in losing the accumulated rent credits and option fee. To mitigate this risk, it's crucial to have a clear plan to improve your financial standing and secure financing within the lease period3.

Turning rent payments into instant equity through a rent-to-own agreement can be a viable strategy for aspiring homeowners. By understanding the terms, exploring your options, and planning strategically, you can leverage this opportunity to secure your financial future. For those ready to take the next step, visiting specialized websites and browsing options can provide the resources and guidance needed to embark on this rewarding journey.