Unlock Savings Compare Medical Billing Coverage Quotes Now

Unlock significant savings on your healthcare expenses by comparing medical billing coverage quotes today, and discover a range of options that could transform your financial health—browse options and see these opportunities right now.

Understanding Medical Billing Coverage

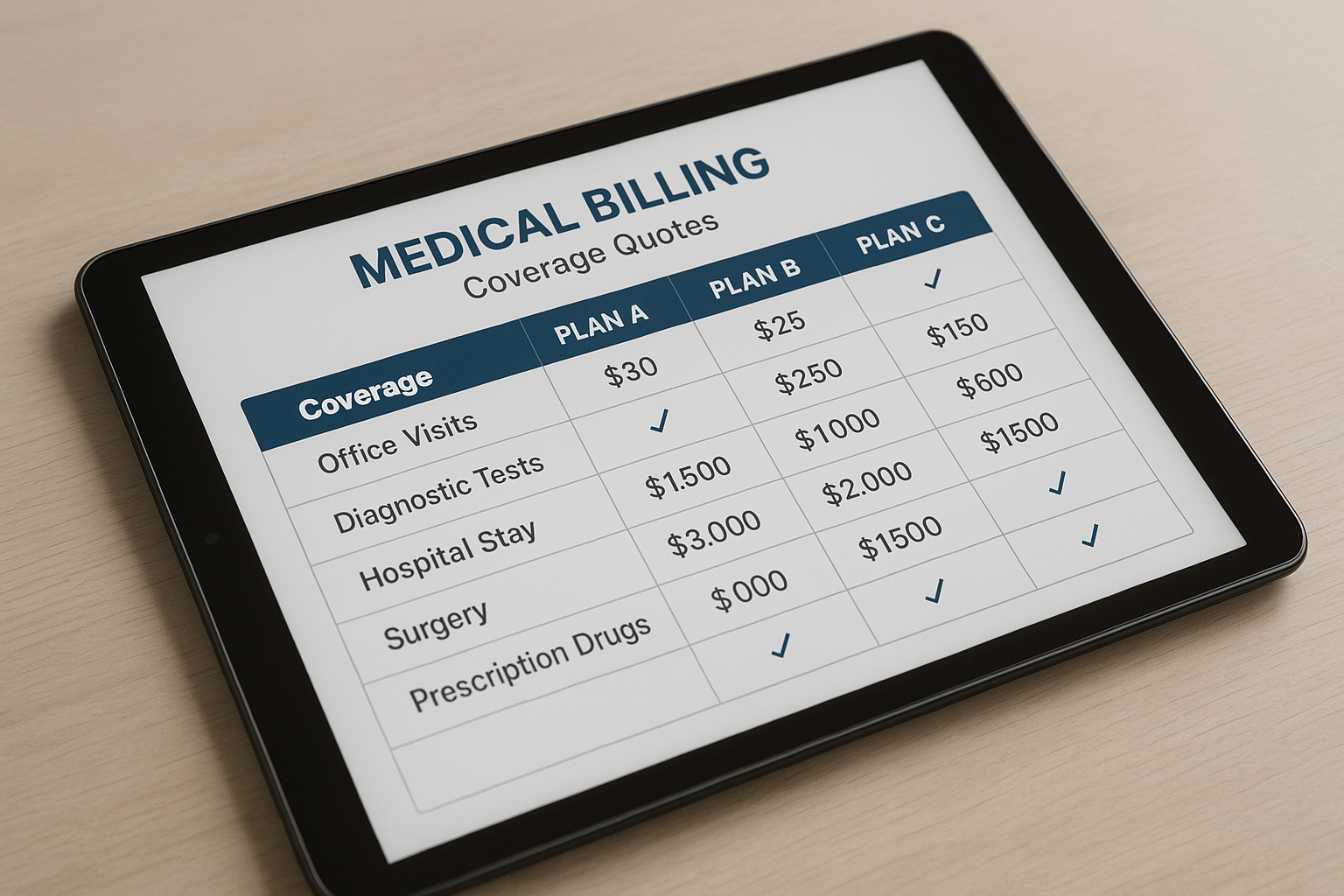

Navigating the complexities of medical billing can often feel daunting, but understanding your coverage options can lead to substantial savings. Medical billing coverage refers to the services and costs your health insurance plan will pay for, which can include hospital visits, surgeries, and prescription medications. By comparing quotes from different providers, you can ensure that you’re getting the most comprehensive coverage at the best price.

The Importance of Comparing Quotes

Comparing medical billing coverage quotes is crucial for several reasons. Firstly, it allows you to identify potential savings. Health insurance providers offer varying premiums, deductibles, and co-payments, which can significantly impact your out-of-pocket expenses. Secondly, comparing quotes can help you find a plan that best suits your healthcare needs. Whether you require frequent doctor visits or specific prescription medications, there’s likely a plan that aligns with your requirements.

Real-World Savings and Benefits

The potential savings from comparing medical billing coverage quotes are substantial. For instance, a study by the Kaiser Family Foundation found that the average annual premium for employer-sponsored family health coverage was $22,221 in 20211. By shopping around, families can find plans that offer similar benefits at lower costs, potentially saving hundreds or even thousands of dollars annually.

Moreover, some providers offer discounts for bundling services or for maintaining a healthy lifestyle. These incentives can further reduce your overall healthcare costs. For example, some insurers provide discounts for non-smokers or for those who regularly participate in wellness programs.

Key Factors to Consider

When comparing medical billing coverage quotes, several factors should be considered:

- Premiums: The monthly cost of your insurance plan.

- Deductibles: The amount you pay out-of-pocket before your insurance begins to cover expenses.

- Co-payments and Co-insurance: Your share of the costs for covered services after meeting your deductible.

- Network Providers: Ensure your preferred doctors and hospitals are within the insurance network to avoid extra charges.

- Coverage Limits: Be aware of any caps on coverage for certain services or treatments.

How to Get Started

To begin comparing medical billing coverage quotes, start by visiting websites of well-known health insurance providers. Many offer online tools that can provide instant quotes based on your personal information and healthcare needs. Additionally, consider consulting with a licensed insurance broker who can offer personalized advice and help you navigate the options available.

Take Action Today

By taking the time to compare medical billing coverage quotes, you can unlock significant savings and ensure that you have the right coverage for your needs. Whether you’re looking to reduce premiums, lower deductibles, or find a plan that covers specific treatments, there are options available that can provide both financial relief and peace of mind. Explore these opportunities today and take control of your healthcare expenses.